Summary

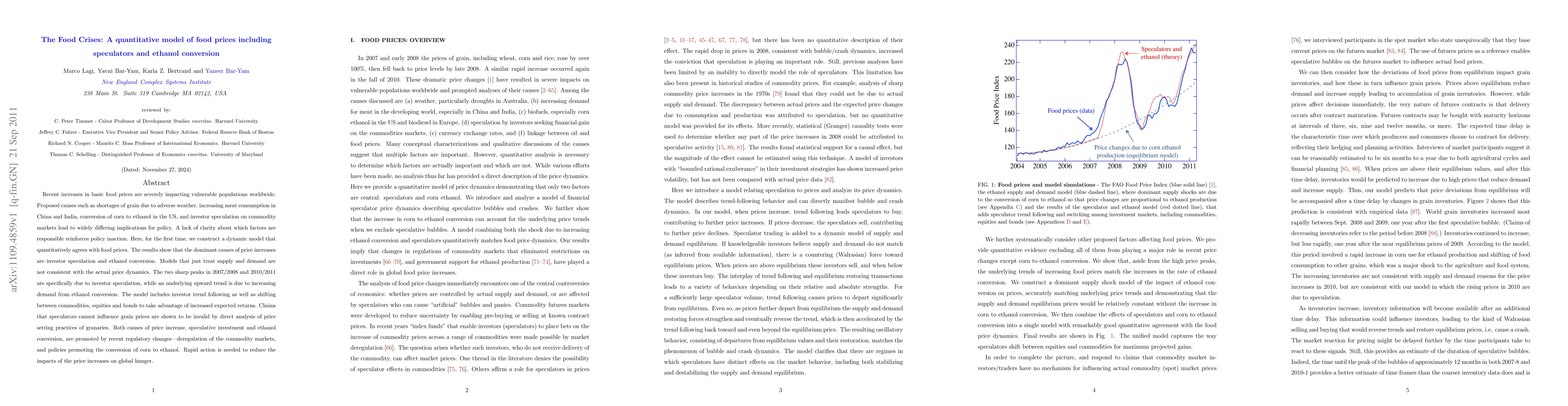

Recent increases in basic food prices are severely impacting vulnerable populations worldwide. Proposed causes such as shortages of grain due to adverse weather, increasing meat consumption in China and India, conversion of corn to ethanol in the US, and investor speculation on commodity markets lead to widely differing implications for policy. A lack of clarity about which factors are responsible reinforces policy inaction. Here, for the first time, we construct a dynamic model that quantitatively agrees with food prices. The results show that the dominant causes of price increases are investor speculation and ethanol conversion. Models that just treat supply and demand are not consistent with the actual price dynamics. The two sharp peaks in 2007/2008 and 2010/2011 are specifically due to investor speculation, while an underlying upward trend is due to increasing demand from ethanol conversion. The model includes investor trend following as well as shifting between commodities, equities and bonds to take advantage of increased expected returns. Claims that speculators cannot influence grain prices are shown to be invalid by direct analysis of price setting practices of granaries. Both causes of price increase, speculative investment and ethanol conversion, are promoted by recent regulatory changes---deregulation of the commodity markets, and policies promoting the conversion of corn to ethanol. Rapid action is needed to reduce the impacts of the price increases on global hunger.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)