Summary

This study introduces the concept of the forking effect in the cryptocurrency market,specifically focusing on the impact of forking events on bitcoin, also called parent coin.We use a modified exponential GARCH model to examine the bitcoin's response inreturns and volatility. Our findings reveal that forking events do not significantlyaffect the bitcoin's returns but have a strong positive impact on its volatility, especially when considering market dynamics. Our model accounts for key features likevolatility clustering and fat-tailed distributions. Additionally, we observe that following a fork event, volatility remains elevated for the next three days, regardless ofother forking events, and the volatility impact does not increase when multiple forksoccur simultaneously on the same day.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

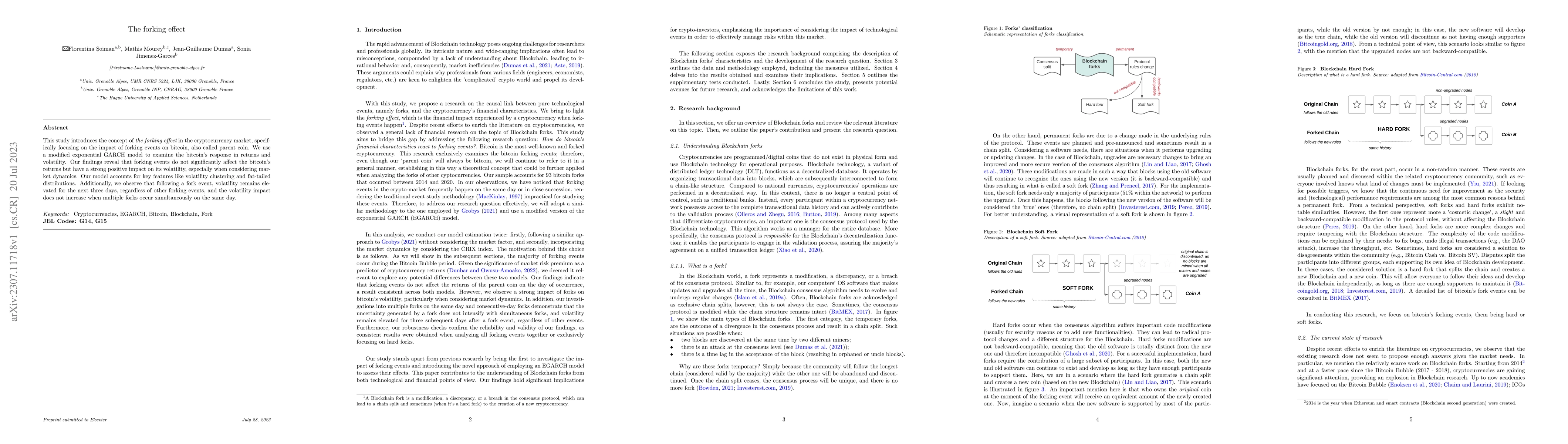

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)