Summary

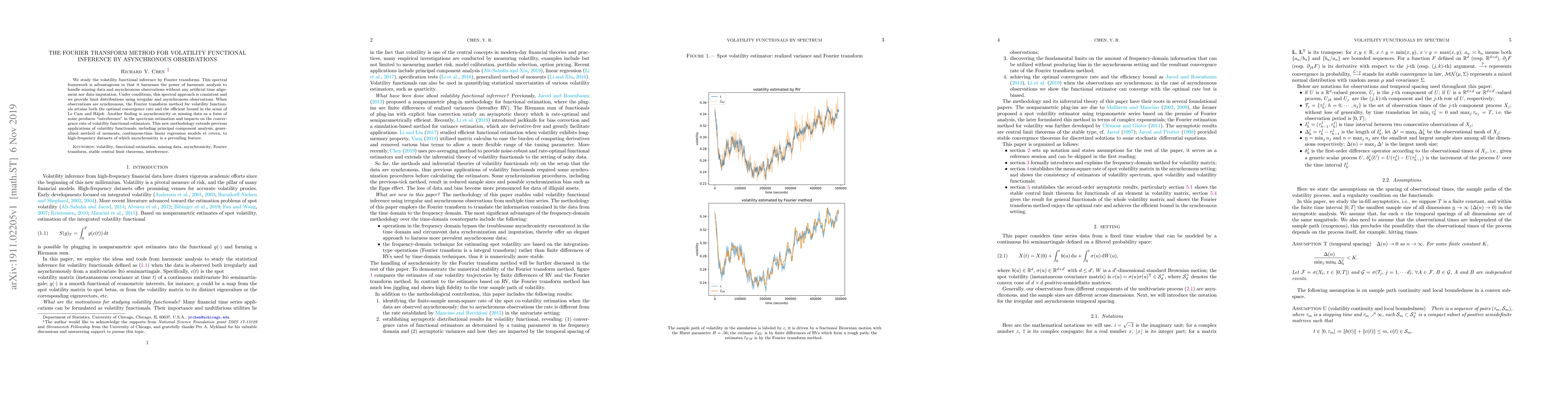

We study the volatility functional inference by Fourier transforms. This spectral framework is advantageous in that it harnesses the power of harmonic analysis to handle missing data and asynchronous observations without any artificial time alignment nor data imputation. Under conditions, this spectral approach is consistent and we provide limit distributions using irregular and asynchronous observations. When observations are synchronous, the Fourier transform method for volatility functionals attains both the optimal convergence rate and the efficient bound in the sense of Le Cam and H\'ajek. Another finding is asynchronicity or missing data as a form of noise produces "interference" in the spectrum estimation and impacts on the convergence rate of volatility functional estimators. This new methodology extends previous applications of volatility functionals, including principal component analysis, generalized method of moments, continuous-time linear regression models et cetera, to high-frequency datasets of which asynchronicity is a prevailing feature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Fourier-Malliavin Volatility (FMVol) MATLAB library

Giacomo Toscano, Simona Sanfelici

| Title | Authors | Year | Actions |

|---|

Comments (0)