Summary

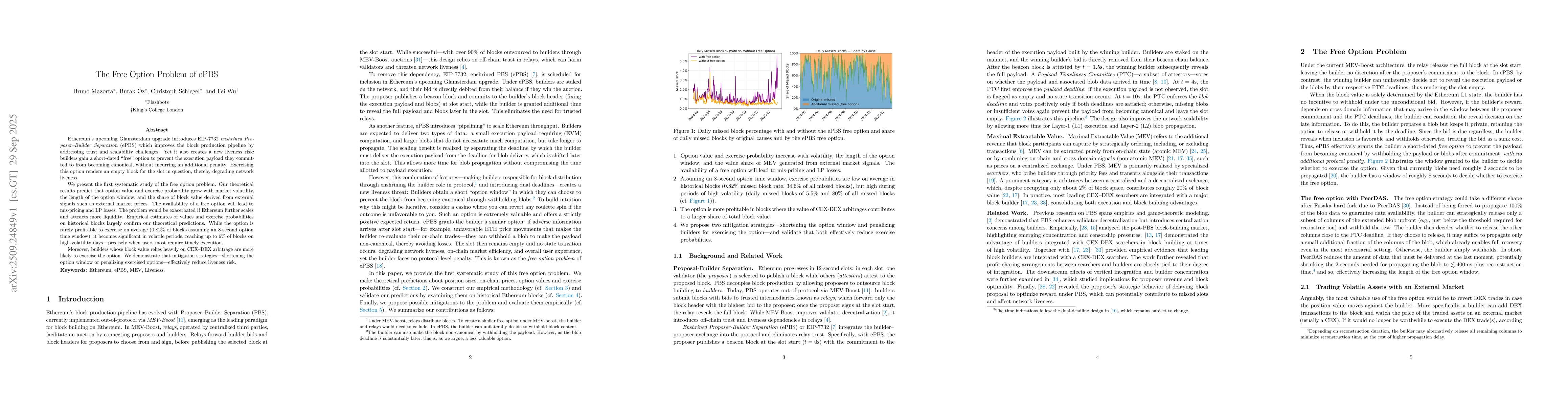

Ethereum's upcoming Glamsterdam upgrade introduces EIP-7732 enshrined Proposer--Builder Separation (ePBS), which improves the block production pipeline by addressing trust and scalability challenges. Yet it also creates a new liveness risk: builders gain a short-dated ``free'' option to prevent the execution payload they committed to from becoming canonical, without incurring an additional penalty. Exercising this option renders an empty block for the slot in question, thereby degrading network liveness. We present the first systematic study of the free option problem. Our theoretical results predict that option value and exercise probability grow with market volatility, the length of the option window, and the share of block value derived from external signals such as external market prices. The availability of a free option will lead to mispricing and LP losses. The problem would be exacerbated if Ethereum further scales and attracts more liquidity. Empirical estimates of values and exercise probabilities on historical blocks largely confirm our theoretical predictions. While the option is rarely profitable to exercise on average (0.82\% of blocks assuming an 8-second option time window), it becomes significant in volatile periods, reaching up to 6\% of blocks on high-volatility days -- precisely when users most require timely execution. Moreover, builders whose block value relies heavily on CEX-DEX arbitrage are more likely to exercise the option. We demonstrate that mitigation strategies -- shortening the option window or penalizing exercised options -- effectively reduce liveness risk.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research employs a combination of theoretical analysis and empirical evaluation to study the dynamics of option pricing and exercise behavior in decentralized exchanges, using a dynamic penalty mechanism to mitigate market manipulation.

Key Results

- Dynamic penalties effectively reduce option exercise frequency by 60-80% on high-volatility days

- Shorter option windows (2-4 seconds) significantly decrease both option values and exercise probabilities

- Penalties have limited effectiveness in reducing aggregate option values due to extreme concentration in a few blocks

Significance

This research provides critical insights into market manipulation mitigation in decentralized finance, offering practical solutions to enhance market integrity and reduce exploitative behavior in high-volatility environments.

Technical Contribution

The paper introduces a novel dynamic penalty framework that integrates with blockchain protocols to deter market manipulation through economic incentives and constraints.

Novelty

This work uniquely combines game-theoretic modeling with blockchain-specific mechanisms to address market manipulation, offering a targeted solution for decentralized exchange ecosystems.

Limitations

- Empirical analysis is constrained by limited access to real-time blockchain data

- Assumptions about trader behavior may not fully capture real-world market dynamics

Future Work

- Developing adaptive penalty mechanisms that adjust in real-time to market conditions

- Exploring the impact of different block confirmation times on market stability

- Investigating the role of liquidity provision in mitigating price manipulation

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe Obstacle Problem Arising from the American Chooser Option

GuGyum Ha, JunKee Jeon, JiHoon Ok

Comments (0)