Summary

We investigate the general structure of optimal investment and consumption with small proportional transaction costs. For a safe asset and a risky asset with general continuous dynamics, traded with random and time-varying but small transaction costs, we derive simple formal asymptotics for the optimal policy and welfare. These reveal the roles of the investors' preferences as well as the market and cost dynamics, and also lead to a fully dynamic model for the implied trading volume. In frictionless models that can be solved in closed form, explicit formulas for the leading-order corrections due to small transaction costs are obtained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

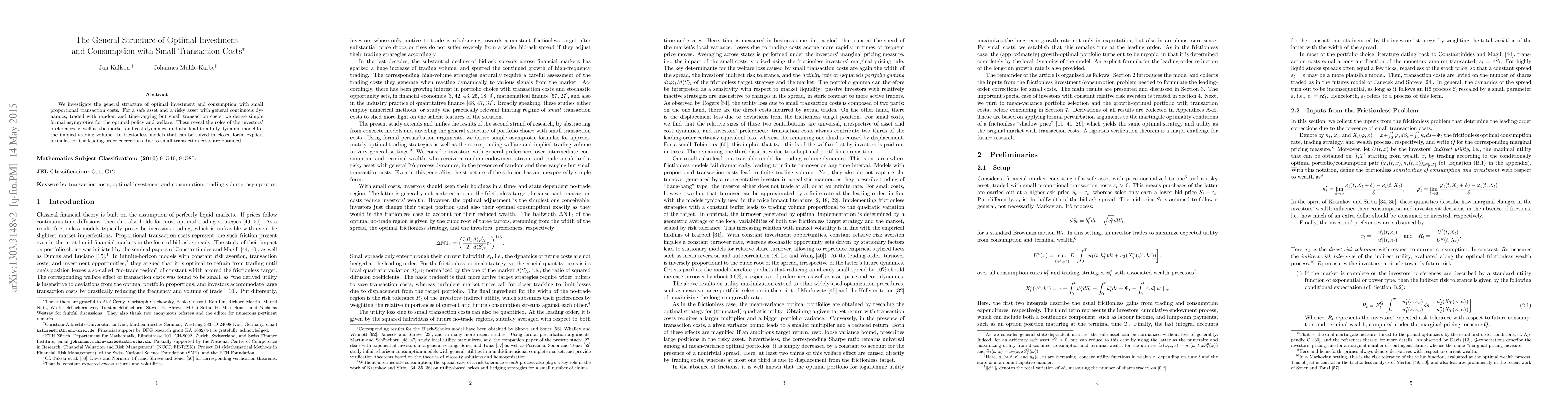

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)