Summary

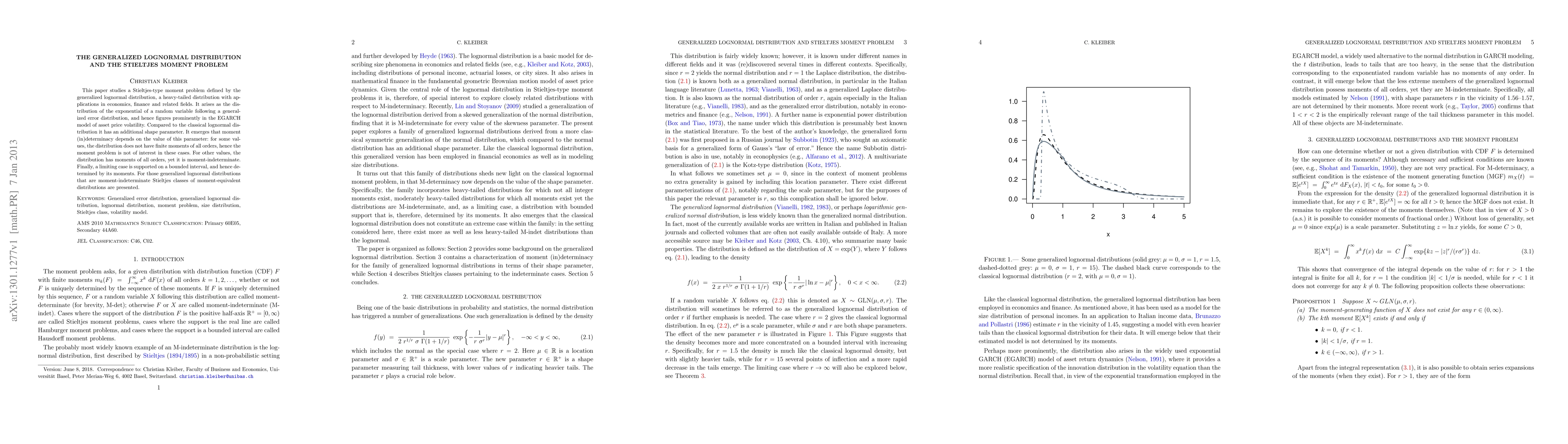

This paper studies a Stieltjes-type moment problem defined by the generalized lognormal distribution, a heavy-tailed distribution with applications in economics, finance and related fields. It arises as the distribution of the exponential of a random variable following a generalized error distribution, and hence figures prominently in the EGARCH model of asset price volatility. Compared to the classical lognormal distribution it has an additional shape parameter. It emerges that moment (in)determinacy depends on the value of this parameter: for some values, the distribution does not have finite moments of all orders, hence the moment problem is not of interest in these cases. For other values, the distribution has moments of all orders, yet it is moment-indeterminate. Finally, a limiting case is supported on a bounded interval, and hence determined by its moments. For those generalized lognormal distributions that are moment-indeterminate Stieltjes classes of moment-equivalent distributions are presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)