Authors

Summary

We consider a class of economic growth models that includes the classical Ramsey--Cass--Koopmans capital accumulation model and verify that, under several assumptions, the value function of the model is the unique viscosity solution to the Hamilton--Jacobi--Bellman equation. Moreover, we discuss a solution method for these models using differential inclusion, where the subdifferential of the value function plays an important role. Next, we present an assumption under which the value function is a classical solution to the Hamilton--Jacobi--Bellman equation, and show that many economic models satisfy this assumption. In particular, our result still holds in an economic growth model in which the government takes a non-smooth Keynesian policy rule.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

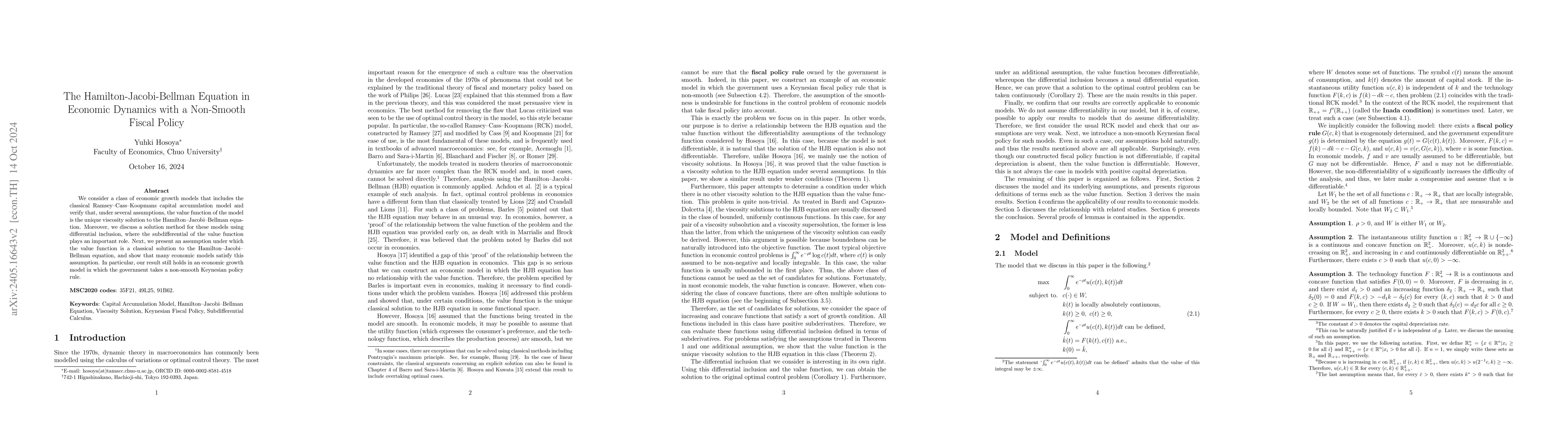

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)