Summary

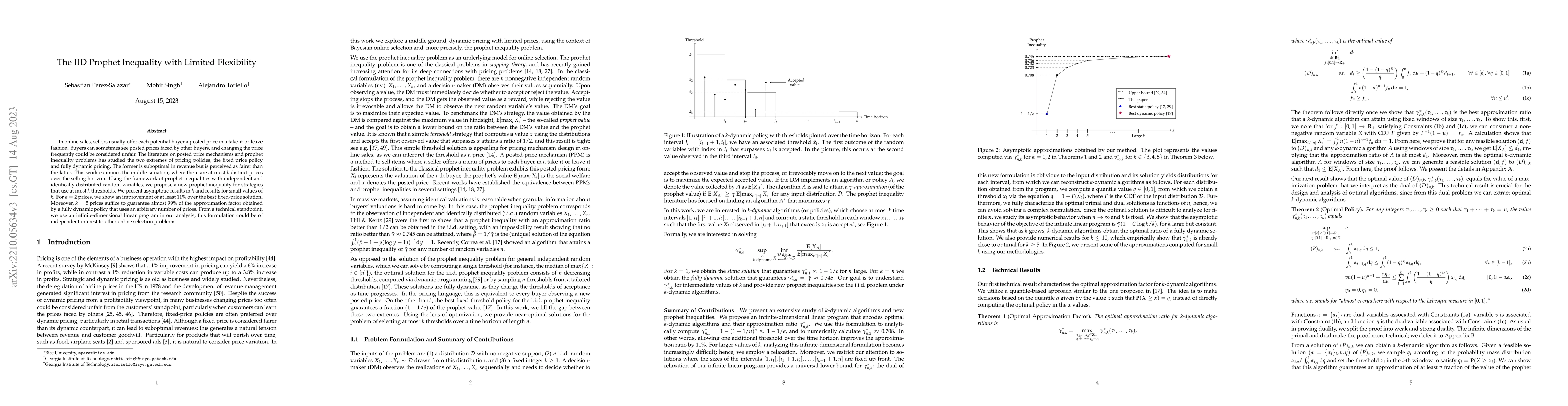

In online sales, sellers usually offer each potential buyer a posted price in a take-it-or-leave fashion. Buyers can sometimes see posted prices faced by other buyers, and changing the price frequently could be considered unfair. The literature on posted price mechanisms and prophet inequality problems has studied the two extremes of pricing policies, the fixed price policy and fully dynamic pricing. The former is suboptimal in revenue but is perceived as fairer than the latter. This work examines the middle situation, where there are at most $k$ distinct prices over the selling horizon. Using the framework of prophet inequalities with independent and identically distributed random variables, we propose a new prophet inequality for strategies that use at most $k$ thresholds. We present asymptotic results in $k$ and results for small values of $k$. For $k=2$ prices, we show an improvement of at least $11\%$ over the best fixed-price solution. Moreover, $k=5$ prices suffice to guarantee almost $99\%$ of the approximation factor obtained by a fully dynamic policy that uses an arbitrary number of prices. From a technical standpoint, we use an infinite-dimensional linear program in our analysis; this formulation could be of independent interest to other online selection problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIID Prophet Inequality with Random Horizon: Going Beyond Increasing Hazard Rates

Giordano Giambartolomei, Frederik Mallmann-Trenn, Raimundo Saona

Repeated Prophet Inequality with Near-optimal Bounds

Krishnendu Chatterjee, Raimundo Saona, Mona Mohammadi

| Title | Authors | Year | Actions |

|---|

Comments (0)