Authors

Summary

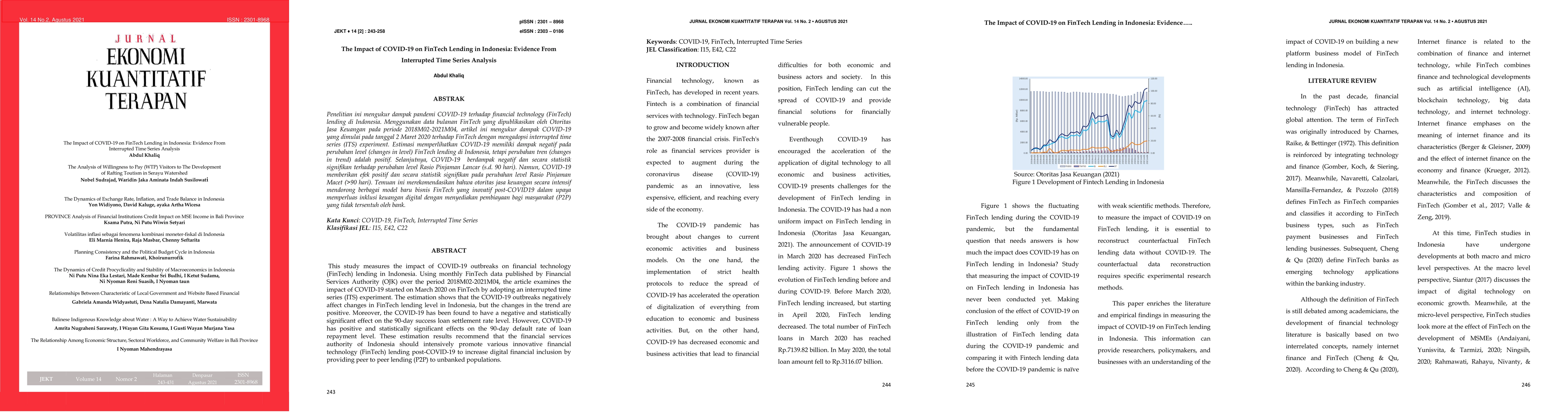

This study measures the impact of COVID-19 outbreaks on financial technology (FinTech) lending in Indonesia. Using monthly FinTech data published by Financial Services Authority (OJK) over the period 2018M02-2021M04, the article examines the impact of COVID-19 started on March 2020 on FinTech by adopting an interrupted time series (ITS) experiment. The estimation shows that the COVID-19 outbreaks negatively affect changes in FinTech lending level in Indonesia, but the changes in the trend are positive. Moreover, the COVID-19 has been found to have a negative and statistically significant effect on the 90-day success loan settlement rate level. However, COVID-19 has positive and statistically significant effects on the 90-day default rate of loan repayment level. These estimation results recommend that the financial services authority of Indonesia should intensively promote various innovative financial technology (FinTech) lending post-COVID-19 to increase digital financial inclusion by providing peer to peer lending (P2P) to unbanked populations.

AI Key Findings

Generated Jun 08, 2025

Methodology

The study uses an interrupted time series (ITS) analysis with monthly FinTech lending data from 2018 to 2021 in Indonesia, focusing on the period starting from the COVID-19 outbreak in March 2020.

Key Results

- The COVID-19 outbreak negatively impacts the changes in FinTech lending levels in Indonesia, but the trend changes are positive.

- There is a negative and statistically significant effect of COVID-19 on the 90-day success loan settlement rate level.

- COVID-19 has a positive and statistically significant effect on the 90-day default rate of loan repayment level.

Significance

This research is important for understanding the resilience of FinTech lending in Indonesia during the COVID-19 pandemic and for informing policy decisions to promote digital financial inclusion post-COVID-19.

Technical Contribution

The application of interrupted time series analysis to assess the impact of COVID-19 on FinTech lending in Indonesia, providing empirical evidence for policymakers.

Novelty

This work contributes to the literature by focusing on the Indonesian context and by examining both the short-term disruptions and long-term trend shifts in FinTech lending due to the COVID-19 pandemic.

Limitations

- The study is limited to the data available from the Financial Services Authority (OJK) and may not capture all aspects of FinTech lending in Indonesia.

- The findings are based on correlation and not necessarily on causation.

Future Work

- Further research could explore the long-term impacts of COVID-19 on FinTech lending in Indonesia.

- Investigating the effectiveness of specific policy interventions to bolster FinTech lending in post-pandemic scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAssessing the impact of COVID-19 on HIV and hepatitis B testing in Western Iran: insights from an interrupted time series analysis.

Shahabi, Saeed, Bragazzi, Nicola Luigi, Yarahmadi, Mohammad et al.

The impact of COVID-19 and public health measures on homicide and suicide trends in Botswana using an interrupted time series analysis.

Li, Yun, Mugoma, Shathani, Wiebe, Doug et al.

Impact of COVID-19 control measures on influenza positivity among patients with acute respiratory infections, 2018-2023: an interrupted time series analysis.

Chen, Wei, Xu, Xiaoping, Wang, Huabin et al.

Trends in inpatient antibiotic use in Indonesia and the Philippines during the COVID-19 pandemic.

Parwati, Ida, Fazal, Amara Z, McGovern, Olivia L et al.

No citations found for this paper.

Comments (0)