Summary

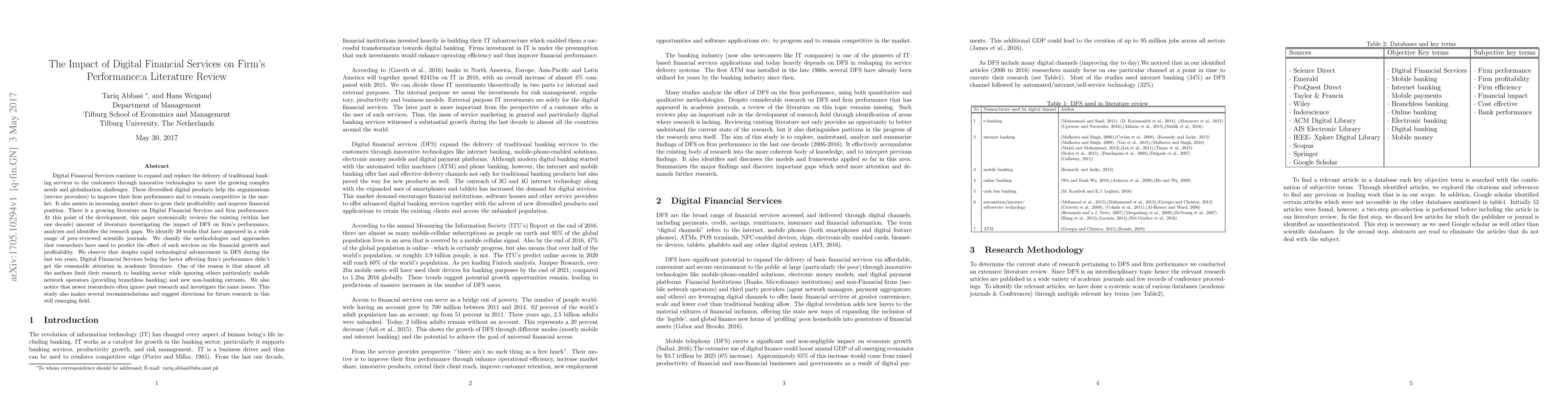

Digital Financial Services continue to expand and replace the delivery of traditional banking services to the customers through innovative technologies to meet the growing complex needs and globalization challenges. These diversified digital products help the organizations (service providers) to improve their firm performance and to remain competitive in the market. It also assists in increasing market share to grow their profitability and improve financial position. There is a growing literature on Digital Financial Services and firm performance. At this point of the development, this paper systemically reviews the existing (within last one decade) amount of literature investigating the impact of DFS on firm performance, analyzes and identifies the research gaps. We identify 39 works that have appeared in a wide range of peer-reviewed scientific journals. We classify the methodologies and approaches that researchers have used to predict the effect of such services on the financial growth and profitability. We observe that despite rapid technological advancement in DFS during the last ten years, Digital Financial Services being the factor affecting firm performance did not get the reasonable attention in academic literature. One of the reason is that almost all the authors limit their research to banking sector while ignoring others particularly mobile network operators (providing branchless banking) and new non-banking entrants. We also notice that newer researchers often ignore past research and investigate the same issues. This study also makes several recommendations and suggest directions for future research in this still emerging field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantifying the Multidimensional Impact of Cyber Attacks in Digital Financial Services: A Systematic Literature Review.

Adekoya, Olumayowa Adefowope, Atlam, Hany F, Lallie, Harjinder Singh

The digital harms of smart home devices: A systematic literature review

Lynne Coventry, David Buil-Gil, Steven Kemp et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)