Summary

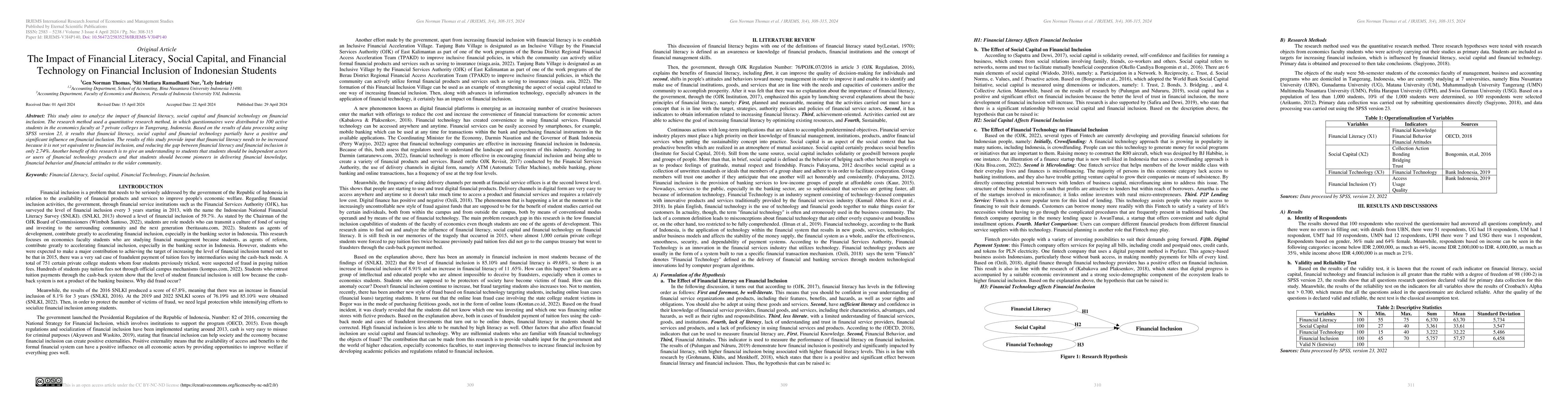

This study aims to analyze the impact of financial literacy, social capital and financial technology on financial inclusion. The research method used a quantitative research method, in which questionnaires were distributed to 100 active students in the economics faculty at 7 private colleges in Tangerang, Indonesia. Based on the results of data processing using SPSS version 23, it results that financial literacy, social capital and financial technology partially have a positive and significant influence on financial inclusion. The results of this study provide input that financial literacy needs to be increased because it is not yet equivalent to financial inclusion, and reducing the gap between financial literacy and financial inclusion is only 2.74%. Another benefit of this research is to give an understanding to students that students should be independent actors or users of financial technology products and that students should become pioneers in delivering financial knowledge, financial behavior and financial attitudes to the wider community.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantifying the Causal Effect of Financial Literacy Courses on Financial Health

Daniel Frees, Arnav Gangal, Charles Shaviro

Analyzing the Impact of Financial Inclusion on Economic Growth in Bangladesh

Ganapati Kumar Biswas

Financial literacy, robo-advising, and the demand for human financial advice: Evidence from Italy

David Aristei, Manuela Gallo

No citations found for this paper.

Comments (0)