Authors

Summary

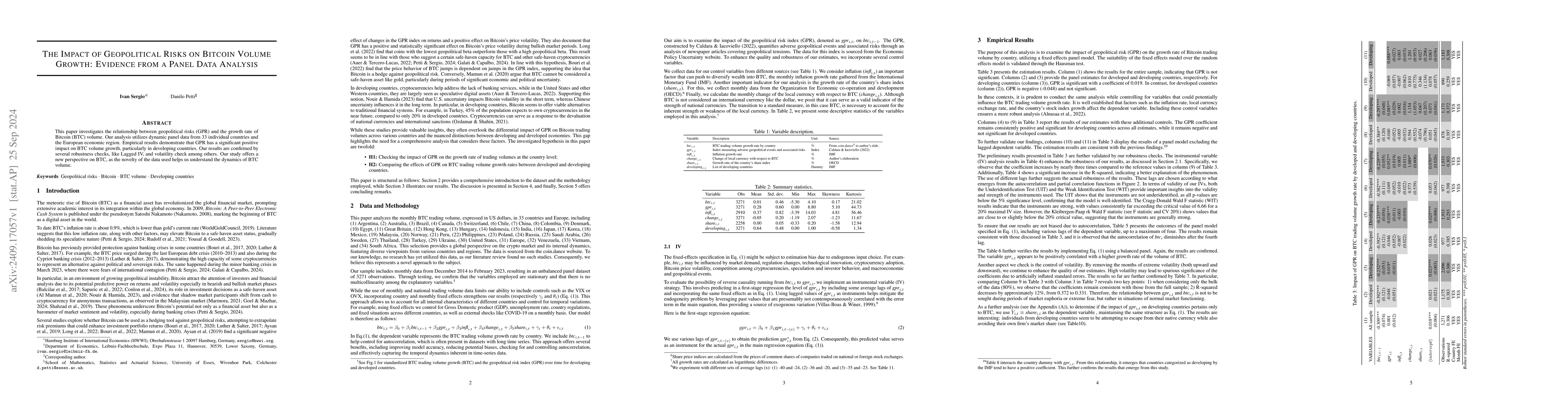

This paper investigates the relationship between geopolitical risks (GPR) and the growth rate of Bitcoin (BTC) volume. Our analysis utilizes dynamic panel data from 33 individual countries and the European economic region. Empirical results demonstrate that GPR has a significant positive impact on BTC volume growth, particularly in developing countries. Our results are confirmed by several robustness checks, like Lagged IV, and volatility check among others. Our study offers a new perspective on BTC, as the novelty of the data used helps us understand the dynamics of BTC volume.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe dynamic connectedness among infectious diseases, geopolitical risks, cryptocurrency, and commodity markets: Evidence from a partial and multiple wavelet analysis.

Ben Ameur, Hanen, Jamaani, Fouad, Abu Alfoul, Mohammed N

The Impact of Geopolitical Conflicts on Trade, Growth, and Innovation

Carlos Góes, Eddy Bekkers

| Title | Authors | Year | Actions |

|---|

Comments (0)