Summary

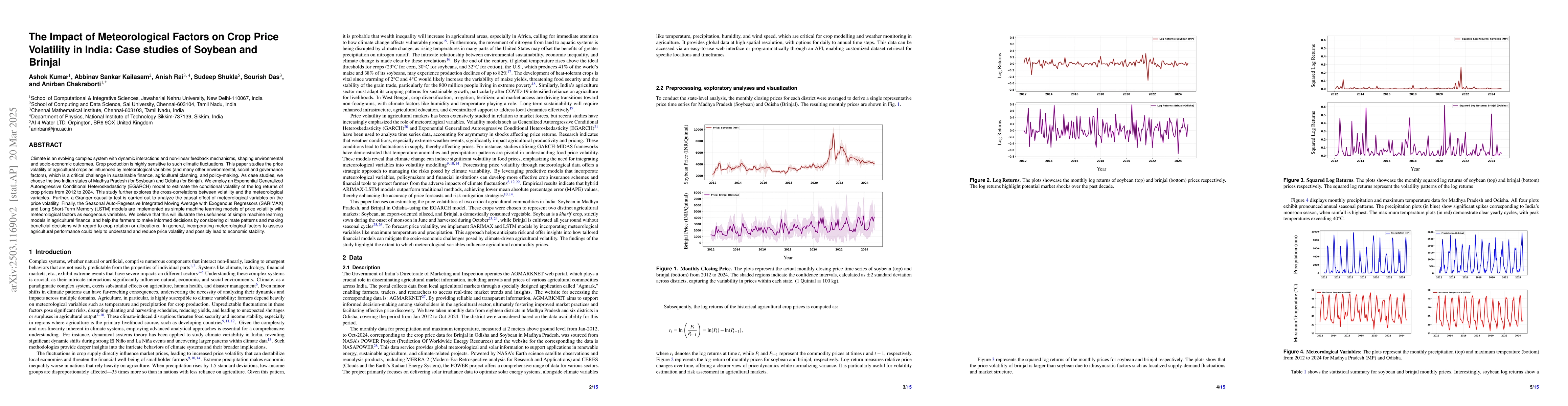

Climate is an evolving complex system with dynamic interactions and non-linear feedback mechanisms, shaping environmental and socio-economic outcomes. Crop production is highly sensitive to such climatic fluctuations. This paper studies the price volatility of agricultural crops as influenced by meteorological variables (and many other environmental, social and governance factors), which is a critical challenge in sustainable finance, agricultural planning, and policy-making. As case studies, we choose the two Indian states of Madhya Pradesh (for Soybean) and Odisha (for Brinjal). We employ an Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model to estimate the conditional volatility of the log returns of crop prices from 2012 to 2024. This study further explores the cross-correlations between volatility and the meteorological variables. Further, a Granger-causality test is carried out to analyze the causal effect of meteorological variables on the price volatility. Finally, the Seasonal Auto-Regressive Integrated Moving Average with Exogenous Regressors (SARIMAX) and Long Short-Term Memory (LSTM) models are implemented as simple machine learning models of price volatility with meteorological factors as exogenous variables. We believe that this will illustrate the usefulness of simple machine learning models in agricultural finance, and help the farmers to make informed decisions by considering climate patterns and making beneficial decisions with regard to crop rotation or allocations. In general, incorporating meteorological factors to assess agricultural performance could help to understand and reduce price volatility and possibly lead to economic stability.

AI Key Findings

Generated Jun 10, 2025

Methodology

This study employs an Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model to estimate the conditional volatility of crop price log returns, using data from 2012 to 2024 for Soybean in Madhya Pradesh and Brinjal in Odisha. Cross-correlation and Granger-causality tests are conducted to analyze the relationship between volatility and meteorological variables. SARIMAX and LSTM models are implemented for predictive modeling.

Key Results

- Soybean exhibits higher price volatility than Brinjal, mainly due to its export-oriented nature and susceptibility to global shocks like the COVID-19 pandemic.

- Brinjal, being a domestically consumed vegetable, shows relatively stable volatility patterns, influenced by local demand and supply, which depend on regional meteorological conditions.

- The SARIMAX model performs better for Brinjal, while both models show similar performance for Soybean, although overall accuracy is lower due to external disruptions.

- The research suggests that improved volatility forecasts can help farmers optimize planting and harvesting schedules, make informed crop allocation decisions, and mitigate economic risks associated with price fluctuations.

- Policymakers can use these insights to develop strategies enhancing market stability and protecting farmers from climate-induced disruptions.

Significance

This research is important for understanding the impact of meteorological factors on crop price volatility, which is crucial for sustainable finance, agricultural planning, and policy-making. It highlights the need to incorporate climate patterns in decision-making processes for crop rotation and allocation.

Technical Contribution

The paper presents a comprehensive analysis using EGARCH, SARIMAX, and LSTM models to estimate and predict crop price volatility considering meteorological factors.

Novelty

This research differentiates itself by focusing on the Indian context, employing advanced time-series models, and emphasizing the importance of meteorological factors in agricultural finance and policy-making.

Limitations

- The study is limited to two specific crops and regions in India, which may not be generalizable to other crops or geographical areas.

- The accuracy of volatility predictions is affected by external disruptions, indicating the need for additional variables in the models.

Future Work

- Expand the study to include more crops and regions to enhance generalizability.

- Incorporate additional factors beyond meteorological variables to refine volatility predictions and better understand agricultural price dynamics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting and Mitigating Agricultural Price Volatility Using Climate Scenarios and Risk Models

Sourish Das, Anirban Chakraborti, Anish Rai et al.

An Indian UAV and leaf image dataset for integrated crop health assessment of soybean crop.

Shinde, Sayali, Attar, Vahida

| Title | Authors | Year | Actions |

|---|

Comments (0)