Summary

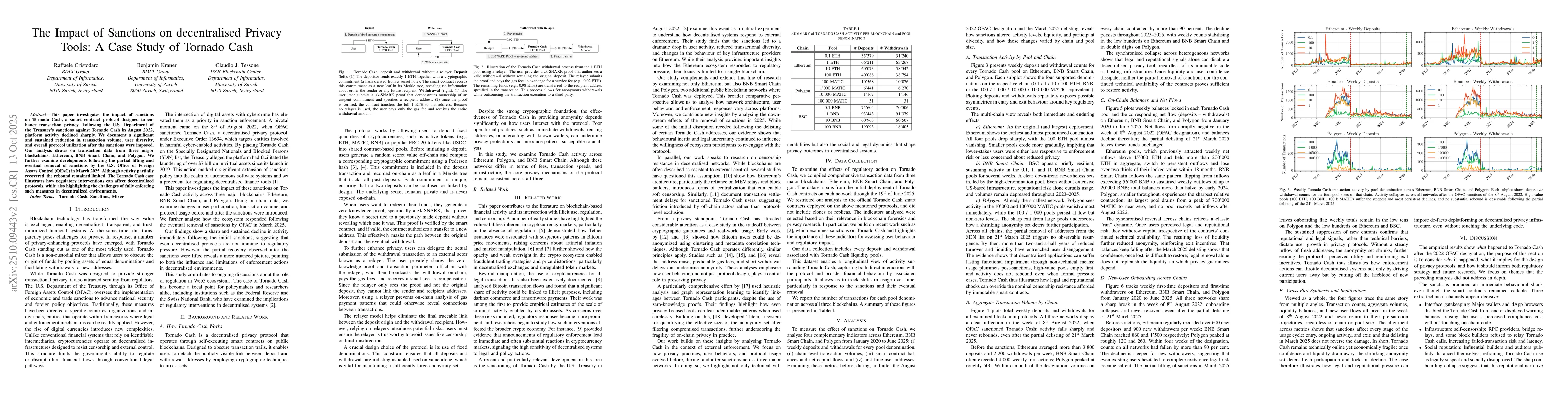

This paper investigates the impact of sanctions on Tornado Cash, a smart contract protocol designed to enhance transaction privacy. Following the U.S. Department of the Treasury's sanctions against Tornado Cash in August 2022, platform activity declined sharply. We document a significant and sustained reduction in transaction volume, user diversity, and overall protocol utilization after the sanctions were imposed. Our analysis draws on transaction data from three major blockchains: Ethereum, BNB Smart Chain, and Polygon. We further examine developments following the partial lifting and eventual removal of sanctions by the U.S. Office of Foreign Assets Control (OFAC) in March 2025. Although activity partially recovered, the rebound remained limited. The Tornado Cash case illustrates how regulatory interventions can affect decentralized protocols, while also highlighting the challenges of fully enforcing such measures in decentralized environments.

AI Key Findings

Generated Oct 17, 2025

Methodology

The study analyzed data from Tornado Cash, including transaction logs, user onboarding metrics, and network activity, alongside regulatory actions and market responses to assess the impact of sanctions on the platform's functionality and user behavior.

Key Results

- Sanctions led to a sharp decline in new user onboarding and transaction activity across all chains.

- Regulatory pressure significantly reduced the anonymity set by deterring participation and increasing transaction monitoring.

- The study identified how decentralized systems can face legal and reputational barriers that affect their resilience and user trust.

Significance

This research highlights the intersection of decentralized finance (DeFi) and regulatory oversight, offering insights into how compliance measures can reshape user behavior and platform dynamics in the blockchain ecosystem.

Technical Contribution

The research provides empirical evidence on how regulatory actions influence decentralized systems, offering a framework for understanding the interplay between compliance and blockchain functionality.

Novelty

This work uniquely combines empirical analysis of blockchain activity with regulatory impact assessment, providing a comprehensive view of how legal pressures shape decentralized financial ecosystems.

Limitations

- The study relies on publicly available data, which may not capture all user activities or motivations.

- It focuses on Tornado Cash and may not generalize to other decentralized mixing services.

Future Work

- Exploring the long-term effects of regulatory frameworks on decentralized applications (dApps) and user trust.

- Investigating the development of privacy-preserving technologies that comply with evolving legal standards.

- Analyzing the role of community-driven governance in mitigating regulatory risks for decentralized platforms.

Paper Details

PDF Preview

Similar Papers

Found 5 papersTutela: An Open-Source Tool for Assessing User-Privacy on Ethereum and Tornado Cash

Kaili Wang, Mariano Mendez, Mike Wu et al.

The Impact of Sanctions on GitHub Developers and Activities

Christoph Treude, Raula Gaikovina Kula, Youmei Fan et al.

Are sanctions for losers? A network study of trade sanctions

Fabio Ashtar Telarico

Comments (0)