Authors

Summary

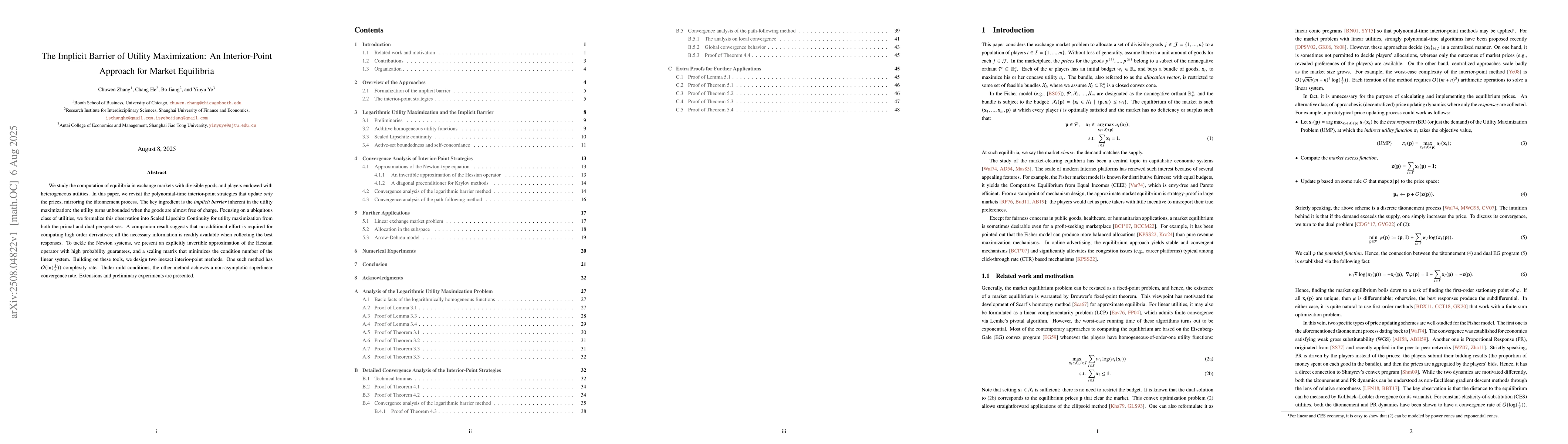

We study the computation of equilibria in exchange markets with divisible goods and players endowed with heterogeneous utilities. In this paper, we revisit the polynomial-time interior-point strategies that update \emph{only} the prices, mirroring the t\^atonnement process. The key ingredient is the \emph{implicit barrier} inherent in the utility maximization: the utility turns unbounded when the goods are almost free of charge. Focusing on a ubiquitous class of utilities, we formalize this observation into Scaled Lipschitz Continuity for utility maximization from both the primal and dual perspectives. A companion result suggests that no additional effort is required for computing high-order derivatives; all the necessary information is readily available when collecting the best responses. To tackle the Newton systems, we present an explicitly invertible approximation of the Hessian operator with high probability guarantees, and a scaling matrix that minimizes the condition number of the linear system. Building on these tools, we design two inexact interior-point methods. One such method has O(ln(1/{\epsilon})) complexity rate. Under mild conditions, the other method achieves a non-asymptotic superlinear convergence rate. Extensions and preliminary experiments are presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe G-Martingale Approach for G-Utility Maximization

Yulin Song, Qiguan Chen, Zengwu Wang et al.

Comments (0)