Authors

Summary

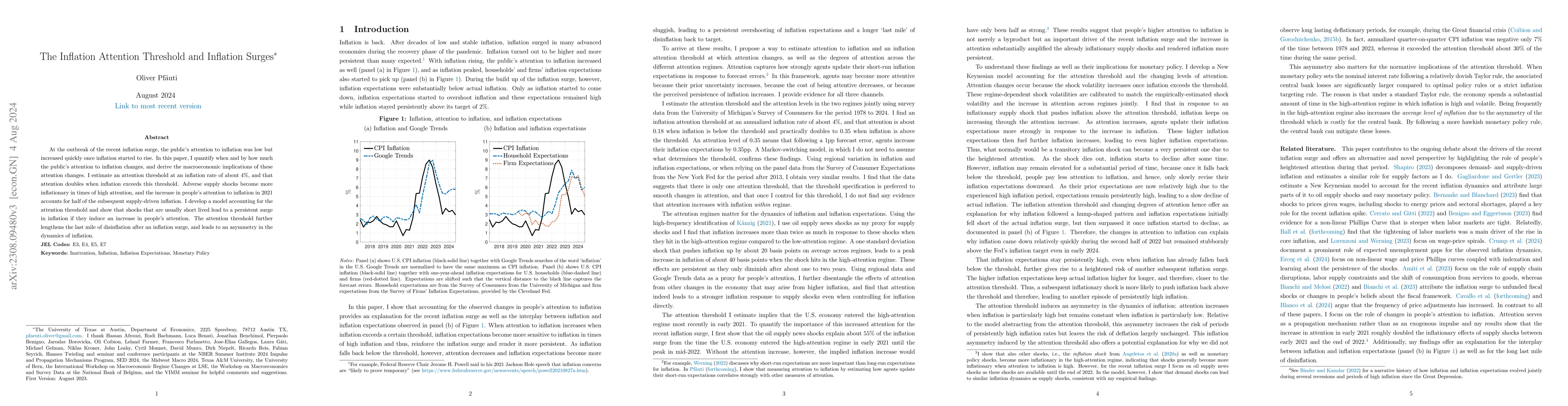

At the outbreak of the recent inflation surge, the public's attention to inflation was low but increased rapidly once inflation started to rise. I develop a framework where this behavior is optimal: agents pay little attention to inflation when inflation is low and stable, but they increase their attention once inflation exceeds a certain threshold. Using survey inflation expectations, I estimate the attention threshold to be at an inflation rate of about 4\%, with attention in the high-attention regime being twice as high as in the low-attention regime. Embedding this into a general equilibrium monetary model, I find that the inflation attention threshold gives rise to a dynamic non-linearity in the Phillips Curve, rendering inflation more sensitive to fluctuations in the output gap during periods of high attention. When calibrated to match the empirical findings, the model generates inflation and inflation expectation dynamics consistent with the recent inflation surge in the US. The attention threshold induces a state dependency: cost-push shocks become more inflationary in times of loose monetary policy. These state-dependent effects are absent in the model with constant attention or under rational expectations. Following simple Taylor rules triggers frequent and prolonged episodes of heightened attention, thereby increasing the volatility of inflation, and - due to the asymmetry of the attention threshold - also the average level of inflation, which leads to substantial welfare losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInflation forecasting with attention based transformer neural networks

Michael Gadermayr, Maximilian Tschuchnig, Petra Tschuchnig et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)