Summary

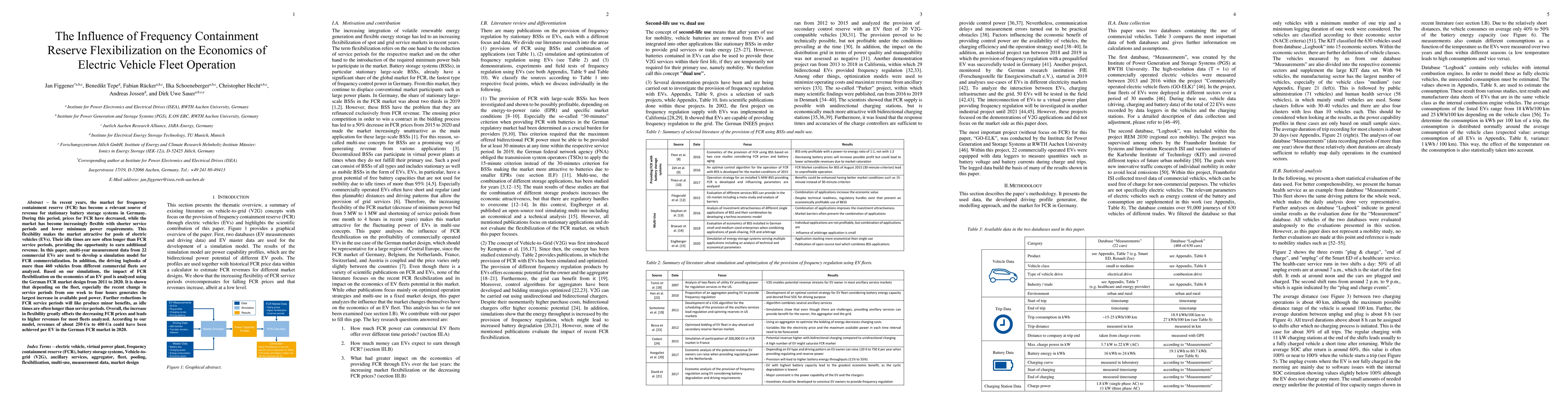

In recent years, the market for frequency containment reserve (FCR) has become a relevant source of revenue for stationary battery storage systems in Germany. During this period, prices for FCR have decreased, while the market has become increasingly flexible with shorter service periods and lower minimum power requirements. This flexibility makes the market attractive for pools of electric vehicles (EVs). Their idle times are now often longer than FCR service periods, providing the opportunity to earn additional revenue. In this paper, multi-year measurement data from 22 commercial EVs are used to develop a simulation model for FCR commercialization. In addition, the driving logbooks of more than 460 vehicles from different commercial fleets are analyzed. Based on our simulations, the impact of FCR flexibilization on the economics of an EV pool is analyzed using the German FCR market design from 2011 to 2020. It is shown that depending on the fleet, especially the recent change in service periods from one week to four hours generates the largest increase in available pool power. Further reductions in FCR service periods will like produce minor benefits, as idle times are often longer than service periods. Overall, the increase in flexibility greatly offsets the decreasing FCR prices and leads to higher revenues for most fleets analyzed. According to our model, revenues of about 250 EUR/a to 400 EUR/a could have been achieved per EV in the German FCR market in 2020.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElectric Autonomous Mobility-on-Demand: Jointly Optimal Vehicle Design and Fleet Operation

Mauro Salazar, Fabio Paparella, Theo Hofman

Electric Vehicle Fleet and Charging Infrastructure Planning

Siva Theja Maguluri, Francisco Castro, Sushil Mahavir Varma

| Title | Authors | Year | Actions |

|---|

Comments (0)