Summary

Classical quantitative finance models such as the Geometric Brownian Motion or its later extensions such as local or stochastic volatility models do not make sense when seen from a physics-based perspective, as they are all equivalent to a negative mass oscillator with a noise. This paper presents an alternative formulation based on insights from physics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

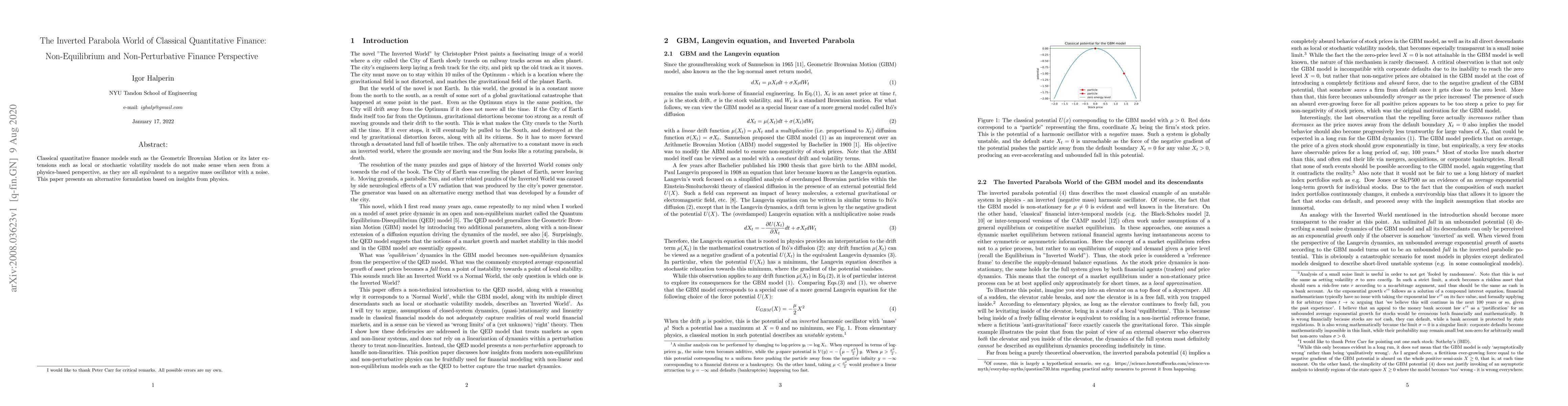

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Evolution of Reinforcement Learning in Quantitative Finance

Cagatay Turkay, Nikolaos Pippas, Elliot A. Ludvig

| Title | Authors | Year | Actions |

|---|

Comments (0)