Summary

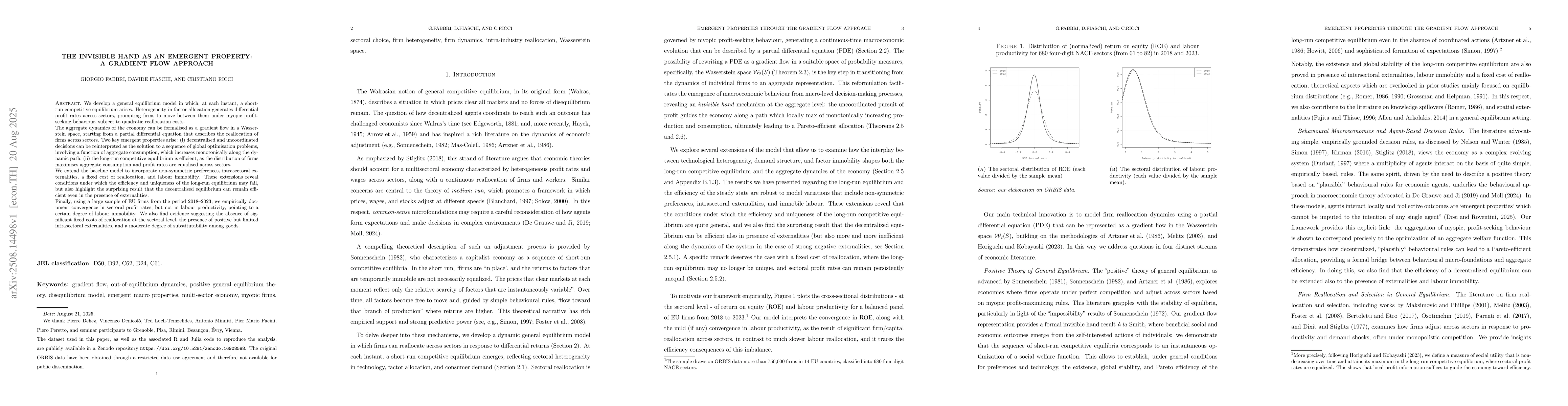

We develop a general equilibrium model in which, at each instant, a short-run competitive equilibrium arises. Heterogeneity in factor allocation generates differential profit rates across sectors, prompting firms to move between them under myopic profit-seeking behaviour, subject to quadratic reallocation costs. The aggregate dynamics of the economy can be formalised as a gradient flow in a Wasserstein space, starting from a partial differential equation that describes the reallocation of firms across sectors. Two key emergent properties arise: (i) decentralised and uncoordinated decisions can be reinterpreted as the solution to a sequence of global optimisation problems, involving a function of aggregate consumption, which increases monotonically along the dynamic path; (ii) the long-run competitive equilibrium is efficient, as the distribution of firms maximises aggregate consumption and profit rates are equalised across sectors. We extend the baseline model to incorporate non-symmetric preferences, intrasectoral externalities, a fixed cost of reallocation, and labour immobility. These extensions reveal conditions under which the efficiency and uniqueness of the long-run equilibrium may fail, but also highlight the surprising result that the decentralised equilibrium can remain efficient even in the presence of externalities. Finally, using a large sample of EU firms from the period 2018-2023, we empirically document convergence in sectoral profit rates, but not in labour productivity, pointing to a certain degree of labour immobility. We also find evidence suggesting the absence of significant fixed costs of reallocation at the sectoral level, the presence of positive but limited intrasectoral externalities, and a moderate degree of substitutability among goods.

AI Key Findings

Generated Aug 21, 2025

Methodology

The research employs a gradient flow approach and the JKO scheme to analyze sectoral reallocation of firms with quadratic reallocation costs, characterizing both short- and long-run competitive equilibria under mild assumptions.

Key Results

- Convergence to long-run competitive equilibrium is established with mild assumptions.

- Efficiency properties of the equilibrium are highlighted, emphasizing the role of substitution elasticity and intrasectoral externalities.

- Fixed reallocation costs can lead to multiple equilibria and path dependence on initial conditions.

- Labor mobility significantly influences efficiency in both short and long run.

- Empirical application to a large sample of EU firms supports the relevance and applicability of the approach.

Significance

This framework provides a solid foundation for analyzing sectoral dynamics and serves as a versatile tool for studying complex processes of factor reallocation, with potential implications for understanding capitalist economies.

Technical Contribution

The paper develops a robust framework using gradient flows and JKO schemes to characterize short- and long-run competitive equilibria, highlighting the critical role of substitution elasticity and intrasectoral externalities in firm distribution.

Novelty

The research introduces a novel approach to analyzing sectoral reallocation dynamics, emphasizing the emergent properties of decentralized, myopic firm behavior and the conditions for efficient long-run equilibria, extending existing literature on complex economic systems.

Limitations

- The model does not account for nominal rigidities in short-run price and sectoral wage adjustments.

- Joint consideration of capital and labor mobility with associated frictions is not explored.

- The model does not explicitly incorporate financial sector dynamics or capital accumulation.

- Limited scope in addressing medium-run fiscal and monetary policy effects.

Future Work

- Explore joint capital and labor mobility with complementarities in production to study resource concentration in specific sectors.

- Investigate the role of a financial sector in facilitating capital mobility without incurring quadratic reallocation costs.

- Incorporate nominal rigidities to enhance the model's relevance for macroeconomic analysis of adjustment dynamics.

Comments (0)