Summary

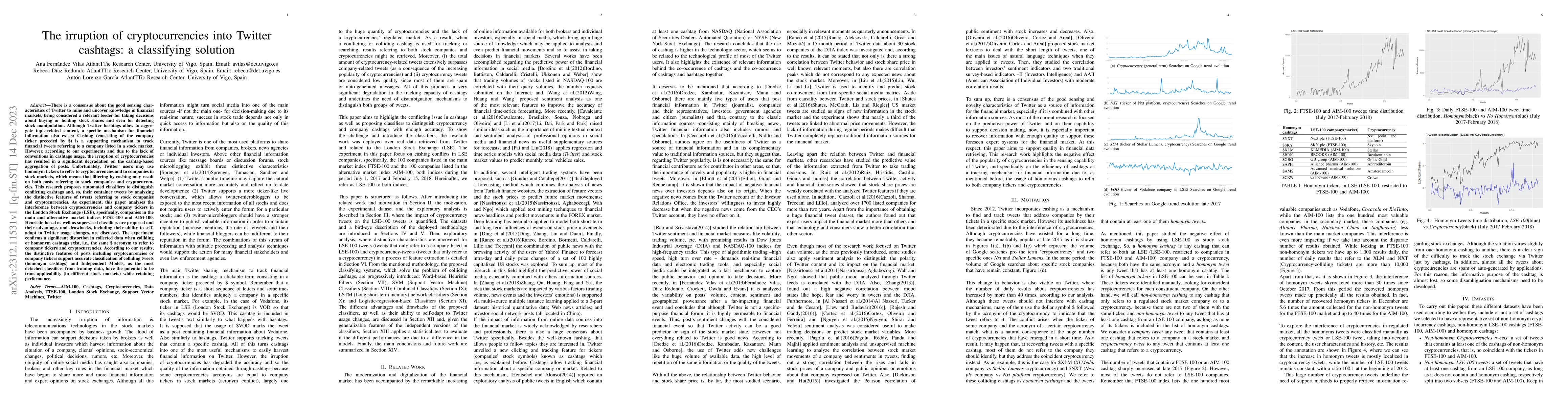

There is a consensus about the good sensing characteristics of Twitter to mine and uncover knowledge in financial markets, being considered a relevant feeder for taking decisions about buying or holding stock shares and even for detecting stock manipulation. Although Twitter hashtags allow to aggregate topic-related content, a specific mechanism for financial information also exists: Cashtag. However, the irruption of cryptocurrencies has resulted in a significant degradation on the cashtag-based aggregation of posts. Unfortunately, Twitter' users may use homonym tickers to refer to cryptocurrencies and to companies in stock markets, which means that filtering by cashtag may result on both posts referring to stock companies and cryptocurrencies. This research proposes automated classifiers to distinguish conflicting cashtags and, so, their container tweets by analyzing the distinctive features of tweets referring to stock companies and cryptocurrencies. As experiment, this paper analyses the interference between cryptocurrencies and company tickers in the London Stock Exchange (LSE), specifically, companies in the main and alternative market indices FTSE-100 and AIM-100. Heuristic-based as well as supervised classifiers are proposed and their advantages and drawbacks, including their ability to self-adapt to Twitter usage changes, are discussed. The experiment confirms a significant distortion in collected data when colliding or homonym cashtags exist, i.e., the same \$ acronym to refer to company tickers and cryptocurrencies. According to our results, the distinctive features of posts including cryptocurrencies or company tickers support accurate classification of colliding tweets (homonym cashtags) and Independent Models, as the most detached classifiers from training data, have the potential to be trans-applicability (in different stock markets) while retaining performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSentiment Analysis in Twitter Social Network Centered on Cryptocurrencies Using Machine Learning

Mahmood Ahmadi, Vahid Amiri

| Title | Authors | Year | Actions |

|---|

Comments (0)