Summary

A complete characterization of the possible joint distributions of the maximum and terminal value of uniformly integrable martingale has been known for some time, and the aim of this paper is to establish a similar characterization for continuous martingales of the joint law of the minimum, final value, and maximum, along with the direction of the final excursion. We solve this problem completely for the discrete analogue, that of a simple symmetric random walk stopped at some almost-surely finite stopping time. This characterization leads to robust hedging strategies for derivatives whose value depends on the maximum, minimum and final values of the underlying asset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

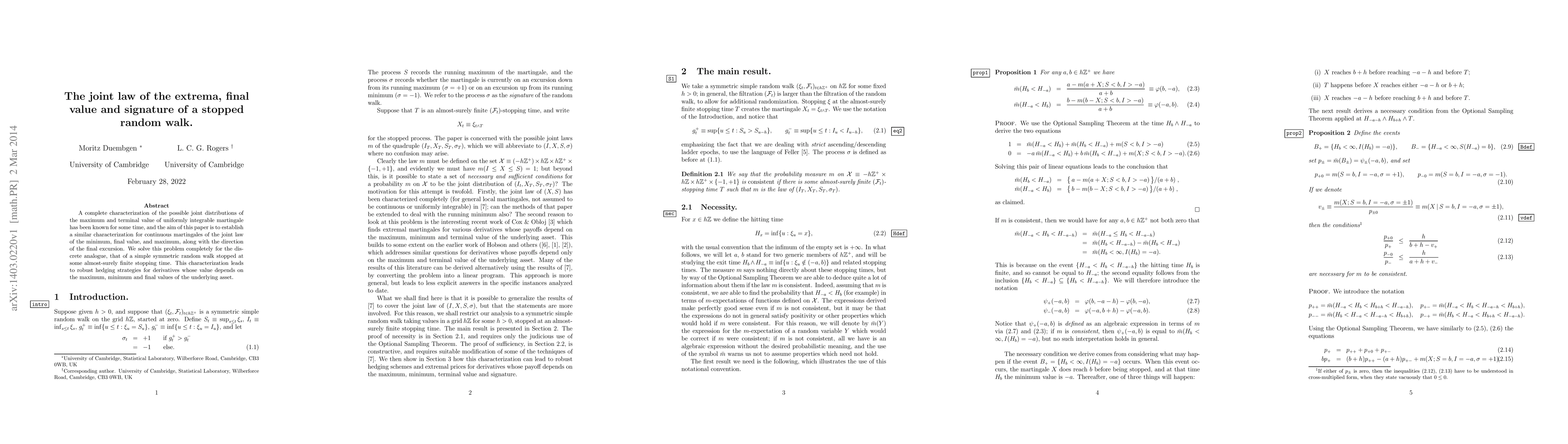

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)