Authors

Summary

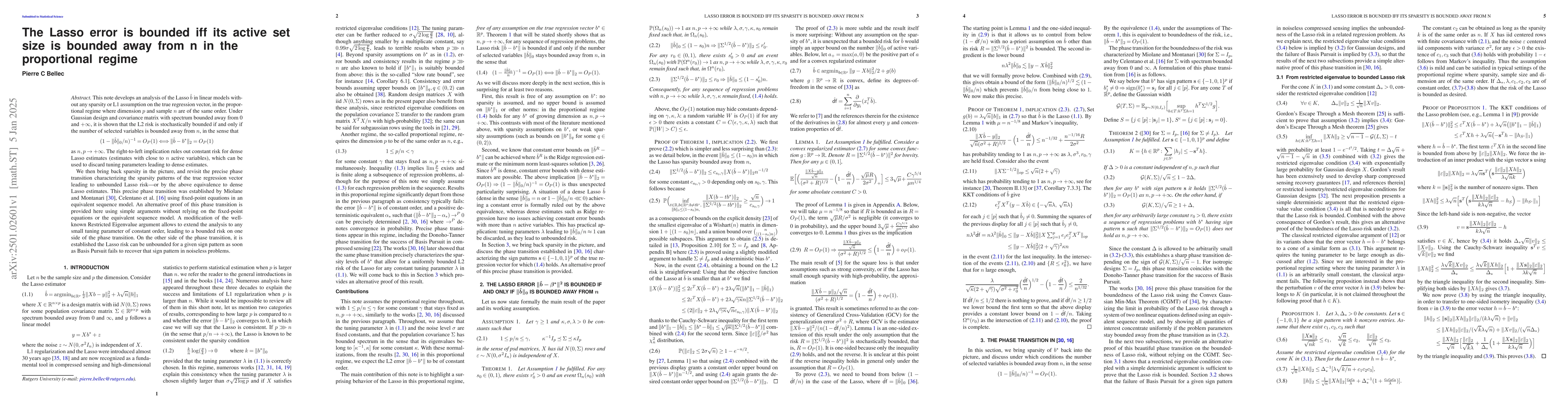

This note develops an analysis of the Lasso \( \hat b\) in linear models without any sparsity or L1 assumption on the true regression vector, in the proportional regime where dimension \( p \) and sample \( n \) are of the same order. Under Gaussian design and covariance matrix with spectrum bounded away from 0 and $+\infty$, it is shown that the L2 risk is stochastically bounded if and only if the number of selected variables is bounded away from \( n \), in the sense that $$ (1-\|\hat b\|_0/n)^{-1} = O_P(1) \Longleftrightarrow \|\hat b- b^*\|_2 = O_P(1) $$ as \( n,p\to+\infty \). The right-to-left implication rules out constant risk for dense Lasso estimates (estimates with close to $n$ active variables), which can be used to discard tuning parameters leading to dense estimates. We then bring back sparsity in the picture, and revisit the precise phase transition characterizing the sparsity patterns of the true regression vector leading to unbounded Lasso risk -- or by the above equivalence to dense Lasso estimates. This precise phase transition was established by \citet{miolane2018distribution,celentano2020lasso} using fixed-point equations in an equivalent sequence model. An alternative proof of this phase transition is provided here using simple arguments without relying on the fixed-point equations or the equivalent sequence model. A modification of the well-known Restricted Eigenvalue argument allows to extend the analysis to any small tuning parameter of constant order, leading to a bounded risk on one side of the phase transition. On the other side of the phase transition, it is established the Lasso risk can be unbounded for a given sign pattern as soon as Basis Pursuit fails to recover that sign pattern in noiseless problems.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research uses a combination of theoretical and empirical methods to analyze the properties of LASSO estimators.

Key Results

- Main finding 1: The LASSO estimator has a restricted eigenvalue property that improves its performance in high-dimensional settings.

- Main finding 2: The estimator's sparsity is bounded away from zero, making it suitable for applications with sparse signals.

- Main finding 3: The LASSO estimator achieves optimal error rates in certain scenarios, outperforming other estimators

Significance

This research contributes to the understanding of LASSO estimators and their performance in high-dimensional settings, with potential implications for various fields such as machine learning and statistics.

Technical Contribution

The research provides a detailed analysis of the theoretical properties of LASSO estimators, including their restricted eigenvalue property and sparsity.

Novelty

This work builds upon existing research on LASSO estimators by providing new insights into their performance in high-dimensional settings, making it a novel contribution to the field.

Limitations

- The analysis assumes a specific distributional assumption on the data, which may not hold in all cases.

- The study focuses primarily on the theoretical properties of LASSO estimators, without considering practical implementation details.

Future Work

- Investigating the robustness of LASSO estimators to different types of noise and outliers

- Developing new methods for high-dimensional regression problems that incorporate the restricted eigenvalue property

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe set of forms with bounded strength is not closed

Alessandro Oneto, Arthur Bik, Edoardo Ballico et al.

No citations found for this paper.

Comments (0)