Summary

The Linked Data Benchmark Council's Financial Benchmark (LDBC FinBench) is a new effort that defines a graph database benchmark targeting financial scenarios such as anti-fraud and risk control. The benchmark has one workload, the Transaction Workload, currently. It captures OLTP scenario with complex, simple read queries and write queries that continuously insert or delete data in the graph. Compared to the LDBC SNB, the LDBC FinBench differs in application scenarios, data patterns, and query patterns. This document contains a detailed explanation of the data used in the LDBC FinBench, the definition of transaction workload, a detailed description for all queries, and instructions on how to use the benchmark suite.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

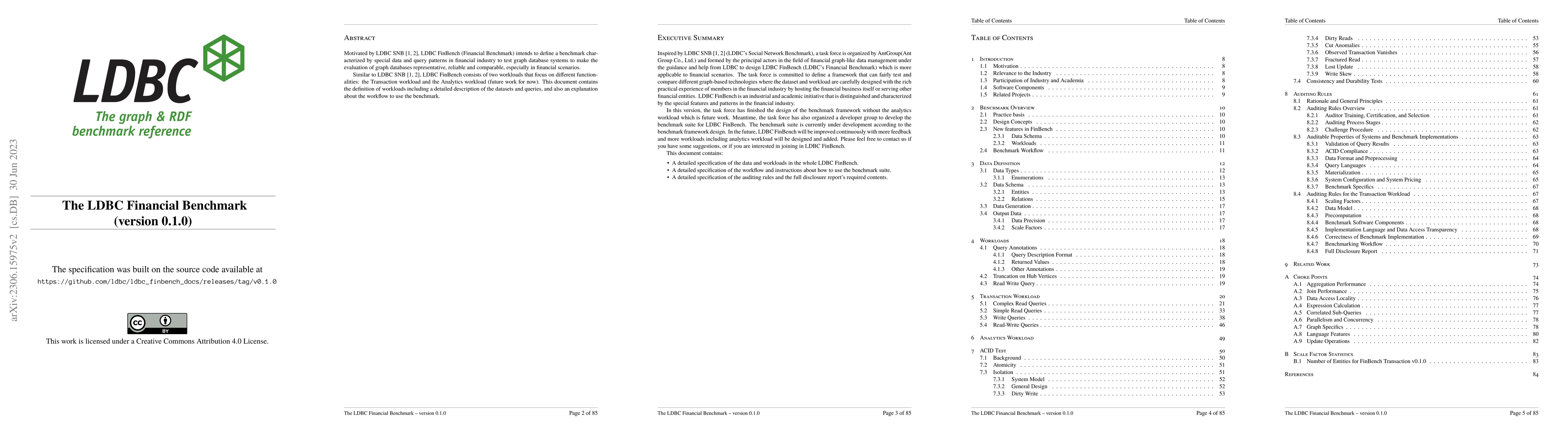

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe LDBC Social Network Benchmark

Yuchen Zhang, Peter Boncz, Marcus Paradies et al.

The LDBC Graphalytics Benchmark

Stijn Heldens, Yinglong Xia, Peter Boncz et al.

The Linked Data Benchmark Council (LDBC): Driving competition and collaboration in the graph data management space

Bin Yang, Chen Zhang, Yan Zhou et al.

The LDBC Social Network Benchmark Interactive workload v2: A transactional graph query benchmark with deep delete operations

Peter Boncz, David Püroja, Gábor Szárnyas et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)