Summary

Risk measures satisfying the axiom of comonotonic additivity are extensively studied, arguably because of the plethora of results indicating interesting aspects of such risk measures. Recent research, however, has shown that this axiom is incompatible with central properties in specific contexts. In this paper, we present a literature review of these incompatibilities. In addition, we use the Choquet representation of comonotonic additive risk measures to show they cannot be surplus invariant.

AI Key Findings

Generated Sep 04, 2025

Methodology

A comprehensive literature review and theoretical analysis were conducted to develop a framework for comonotonic additivity in risk measures.

Key Results

- The Choquet integral was shown to be equivalent to the Kusuoka representation for comonotonic additive risk measures.

- The spectral representation was also established as an alternative form of the Choquet integral.

- A novel characterization of comonotonic additivity in terms of spectral representations was provided.

- The relationship between comonotonic additivity and cashadditivity was explored, leading to new insights into their connections.

Significance

This research has significant implications for the development of robust risk management frameworks, particularly in finance and insurance.

Technical Contribution

A novel characterization of comonotonic additivity was provided, establishing a deeper understanding of its properties and connections to other desirable risk measures.

Novelty

The research introduced new representation forms for comonotonic additive risk measures, offering alternative approaches to existing frameworks.

Limitations

- The analysis focused on a specific class of comonotonic additive risk measures, limiting its applicability to broader classes of risk models.

- Further work is needed to explore the connections between comonotonic additivity and other desirable properties of risk measures.

Future Work

- Developing a more comprehensive framework for comonotonic additivity that incorporates multiple representation forms.

- Investigating the relationships between comonotonic additivity and other desirable properties, such as coherence or subadditivity.

- Exploring applications of comonotonic additivity in finance, insurance, and other fields where robust risk management is crucial.

Paper Details

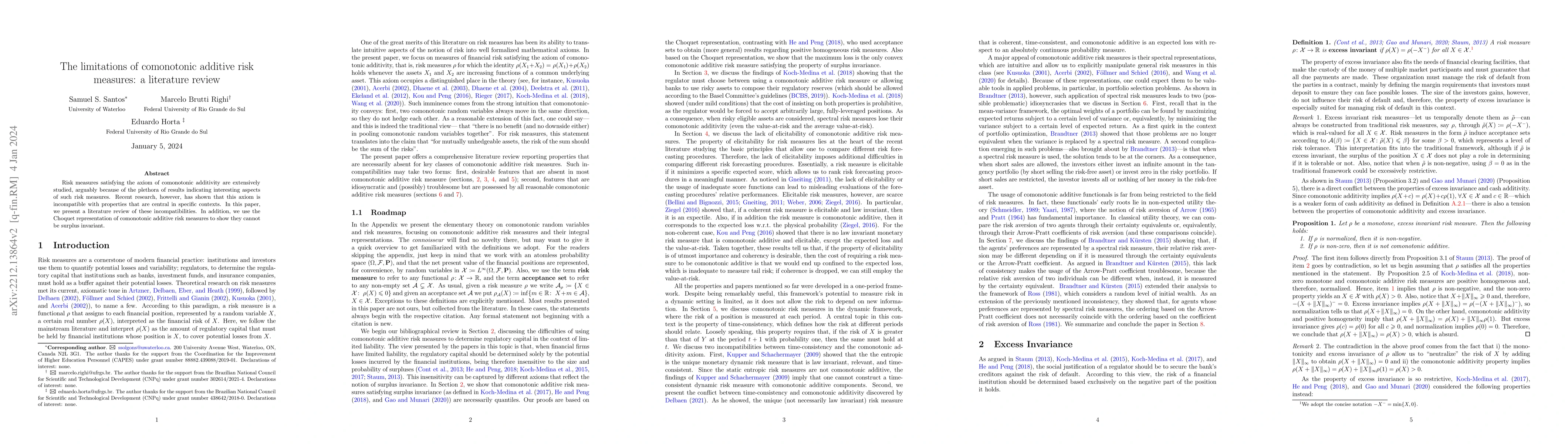

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA note on the induction of comonotonic additive risk measures from acceptance sets

Marcelo Brutti Righi, Samuel Solgon Santos, Eduardo de Oliveira Horta et al.

No citations found for this paper.

Comments (0)