Summary

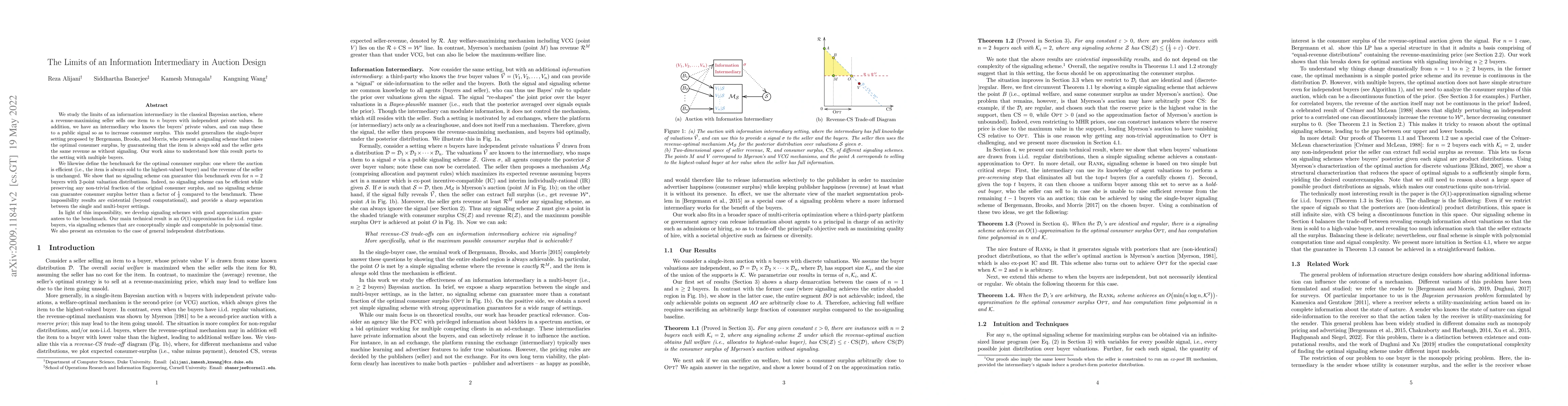

We study the limits of an information intermediary in the classical Bayesian auction, where a revenue-maximizing seller sells one item to $n$ buyers with independent private values. In addition, we have an intermediary who knows the buyers' private values, and can map these to a public signal so as to increase consumer surplus. This model generalizes the single-buyer setting proposed by Bergemann, Brooks, and Morris, who present a signaling scheme that raises the optimal consumer surplus, by guaranteeing that the item is always sold and the seller gets the same revenue as without signaling. Our work aims to understand how this result ports to the setting with multiple buyers. We likewise define the benchmark for the optimal consumer surplus: one where the auction is efficient (i.e., the item is always sold to the highest-valued buyer) and the revenue of the seller is unchanged. We show that no signaling scheme can guarantee this benchmark even for $n=2$ buyers with $2$-point valuation distributions. Indeed, no signaling scheme can be efficient while preserving any non-trivial fraction of the original consumer surplus, and no signaling scheme can guarantee consumer surplus better than a factor of $\frac{1}{2}$ compared to the benchmark. These impossibility results are existential (beyond computational), and provide a sharp separation between the single and multi-buyer settings. In light of this impossibility, we develop signaling schemes with good approximation guarantees to the benchmark. Our main technical result is an $O(1)$-approximation for i.i.d. regular buyers, via signaling schemes that are conceptually simple and computable in polynomial time. We also present an extension to the case of general independent distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Auction Design with Support Information

Jerry Anunrojwong, Santiago R. Balseiro, Omar Besbes

Optimal Referral Auction Design

Palash Dey, Swaprava Nath, Rangeet Bhattacharyya et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)