Authors

Summary

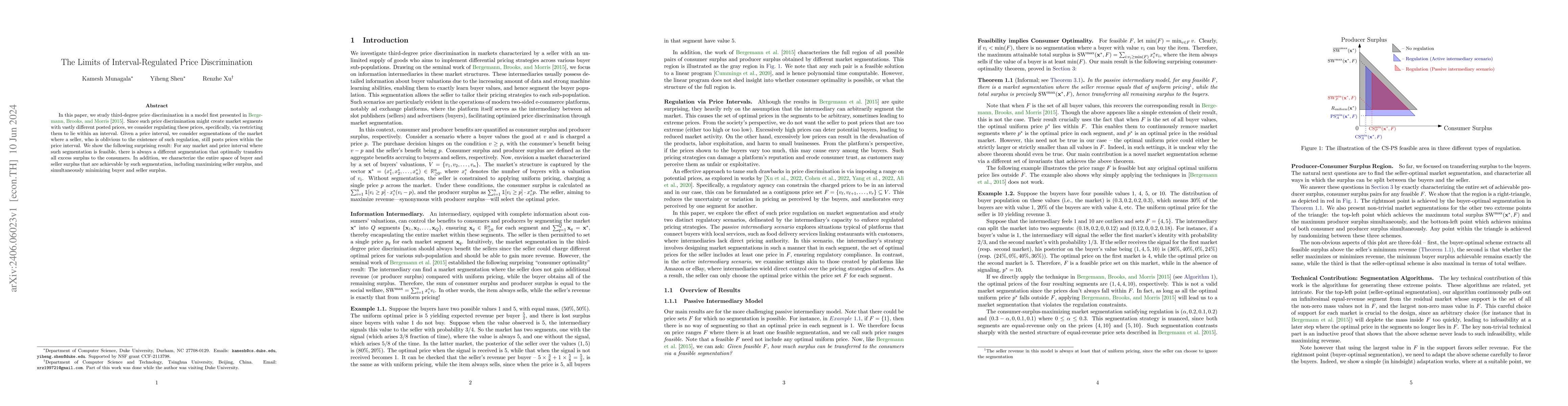

In this paper, we study third-degree price discrimination in a model first presented in Bergemann, Brooks, and Morris [2015]. Since such price discrimination might create market segments with vastly different posted prices, we consider regulating these prices, specifically, via restricting them to lie within an interval. Given a price interval, we consider segmentations of the market where a seller, who is oblivious to the existence of such regulation, still posts prices within the price interval. We show the following surprising result: For any market and price interval where such segmentation is feasible, there is always a different segmentation that optimally transfers all excess surplus to the consumers. In addition, we characterize the entire space of buyer and seller surplus that are achievable by such segmentation, including maximizing seller surplus, and simultaneously minimizing buyer and seller surplus.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Limits of Price Discrimination Under Privacy Constraints

Michael I. Jordan, Alireza Fallah, Ali Makhdoumi et al.

Price discrimination, algorithmic decision-making, and European non-discrimination law

Frederik Zuiderveen Borgesius

Consumer Behavior under Benevolent Price Discrimination

Alexander Erlei, Mattheus Brenig, Nils Engelbrecht

No citations found for this paper.

Comments (0)