Summary

Many fits of Hawkes processes to financial data look rather good but most of them are not statistically significant. This raises the question of what part of market dynamics this model is able to account for exactly. We document the accuracy of such processes as one varies the time interval of calibration and compare the performance of various types of kernels made up of sums of exponentials. Because of their around-the-clock opening times, FX markets are ideally suited to our aim as they allow us to avoid the complications of the long daily overnight closures of equity markets. One can achieve statistical significance according to three simultaneous tests provided that one uses kernels with two exponentials for fitting an hour at a time, and two or three exponentials for full days, while longer periods could not be fitted within statistical satisfaction because of the non-stationarity of the endogenous process. Fitted timescales are relatively short and endogeneity factor is high but sub-critical at about 0.8.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

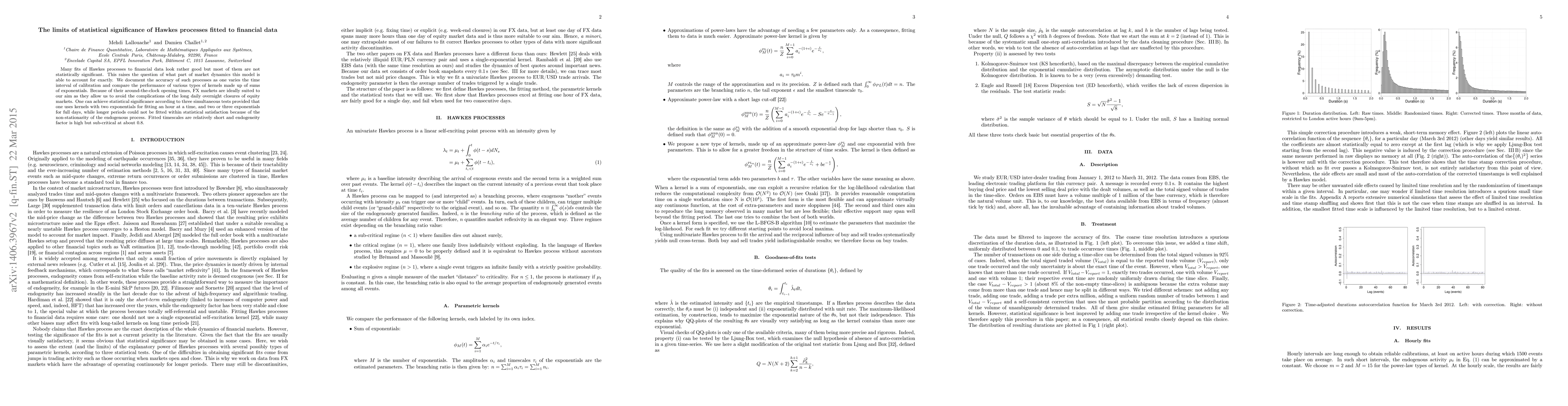

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)