Summary

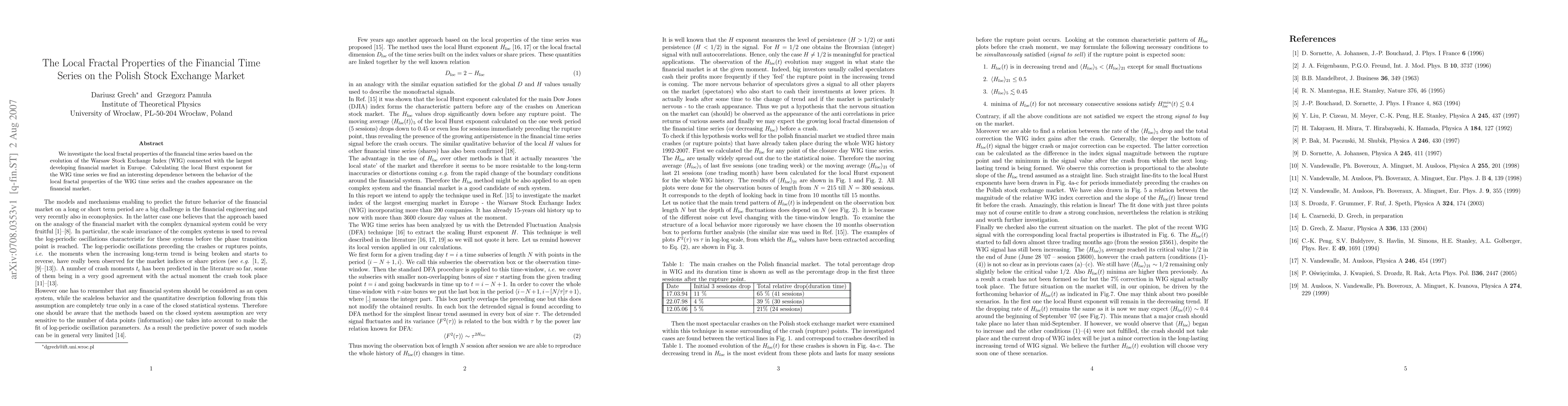

We investigate the local fractal properties of the financial time series based on the evolution of the Warsaw Stock Exchange Index (WIG) connected with the largest developing financial market in Europe. Calculating the local Hurst exponent for the WIG time series we find an interesting dependence between the behavior of the local fractal properties of the WIG time series and the crashes appearance on the financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)