Summary

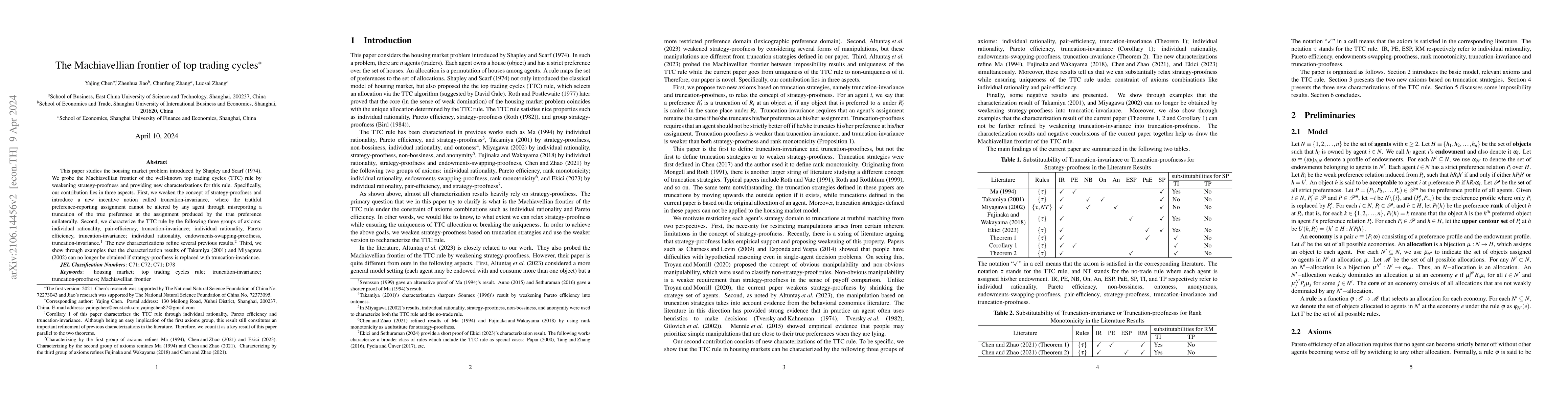

This paper studies the housing market problem introduced by Shapley and Scarf (1974). We probe the Machiavellian frontier of the well-known top trading cycles (TTC) rule by weakening strategy-proofness and providing new characterizations for this rule. Specifically, our contribution lies in three aspects. First, we weaken the concept of strategy-proofness and introduce a new incentive notion called truncation-invariance, where the truthful preference-reporting assignment cannot be altered by any agent through misreporting a truncation of the true preference at the assignment produced by the true preference unilaterally. Second, we characterize the TTC rule by the following three groups of axioms: individual rationality, pair-efficiency, truncation-invariance; individual rationality, Pareto efficiency, truncation-invariance; individual rationality, endowments-swapping-proofness, truncation-invariance.1 The new characterizations refine several previous results.2 Third, we show through examples that the characterization results of Takamiya (2001) and Miyagawa (2002) can no longer be obtained if strategy-proofness is replaced with truncation-invariance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Machiavellian frontier of stable mechanisms

Siyi Zhou, Qiufu Chen, Yuanmei Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)