Summary

The purpose of this article is to describe all possible beliefs of market participants on objective measures under Markovian environments when a risk-neutral measure is given. To achieve this, we employ the Martin integral representation of Markovian pricing kernels. Then, we offer economic and financial implications of this representation. This representation is useful to analyze the long-term behavior of the state variable in the market. The Ross recovery theorem and the long-term behavior of cash flows are discussed as applications.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper employs the Martin integral representation of Markovian pricing kernels to describe all possible beliefs of market participants on objective measures under Markovian environments, given a risk-neutral measure.

Key Results

- All possible beliefs of market participants on objective measures under Markovian environments are described using the Martin integral representation.

- Economic and financial implications of this representation are offered, particularly for analyzing the long-term behavior of the state variable in the market.

- The Ross recovery theorem and the long-term behavior of cash flows are discussed as applications.

Significance

This research is significant as it provides a theoretical framework for understanding market participants' beliefs and long-term behavior of state variables in Markovian environments, which has implications for pricing and risk management in finance.

Technical Contribution

The paper's main technical contribution is the application of the Martin integral representation to describe market participants' beliefs and analyze long-term behavior in Markovian environments.

Novelty

The novelty of this work lies in its application of the Martin integral representation to Markovian pricing kernels, offering new insights into long-term behavior analysis and the Ross recovery theorem.

Limitations

- The paper does not provide explicit empirical evidence or case studies to validate the theoretical findings.

- The complexity of the mathematical framework might limit its direct applicability without further simplification or numerical methods.

Future Work

- Further research could focus on developing numerical methods or simulations to validate and illustrate the theoretical findings.

- Exploring the practical implications and applications of the Martin integral representation in real-world financial markets could be beneficial.

Paper Details

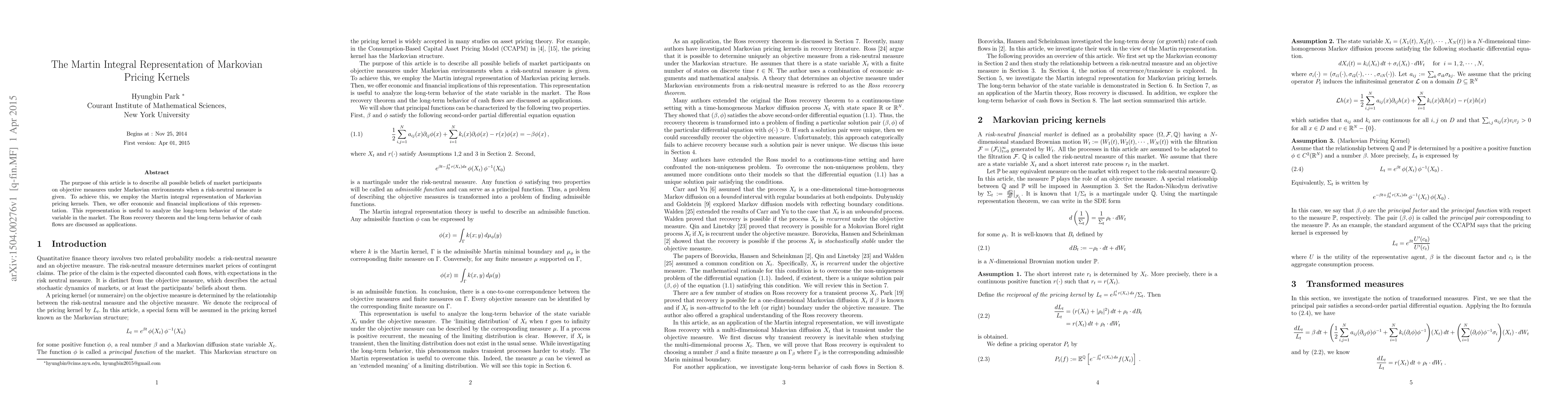

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)