Summary

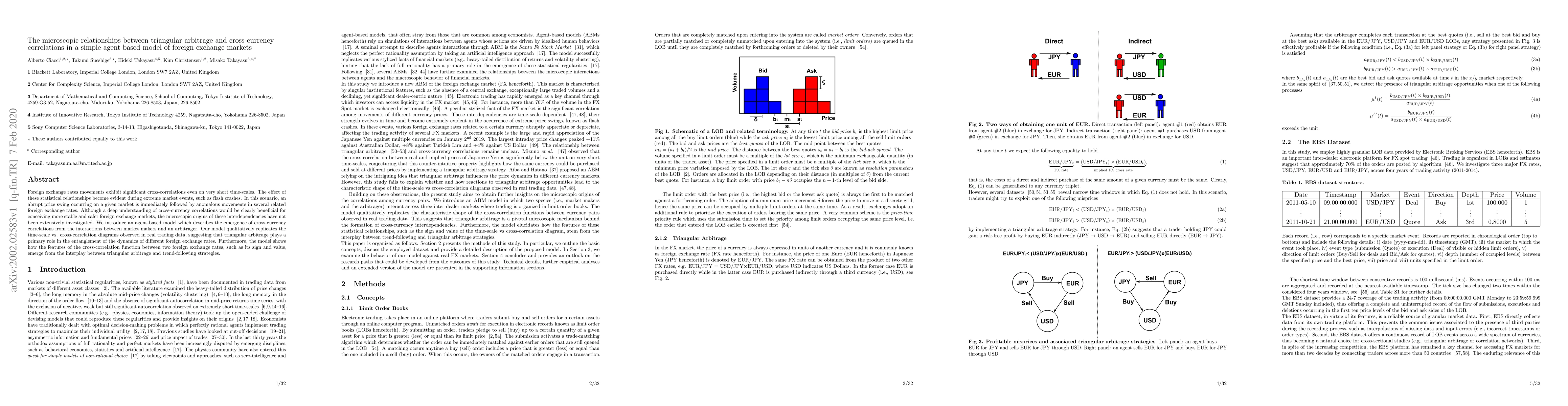

Foreign exchange rates movements exhibit significant cross-correlations even on very short time-scales. The effect of these statistical relationships become evident during extreme market events, such as flash crashes.In this scenario, an abrupt price swing occurring on a given market is immediately followed by anomalous movements in several related foreign exchange rates. Although a deep understanding of cross-currency correlations would be clearly beneficial for conceiving more stable and safer foreign exchange markets, the microscopic origins of these interdependencies have not been extensively investigated. We introduce an agent-based model which describes the emergence of cross-currency correlations from the interactions between market makers and an arbitrager. Our model qualitatively replicates the time-scale vs. cross-correlation diagrams observed in real trading data, suggesting that triangular arbitrage plays a primary role in the entanglement of the dynamics of different foreign exchange rates. Furthermore, the model shows how the features of the cross-correlation function between two foreign exchange rates, such as its sign and value, emerge from the interplay between triangular arbitrage and trend-following strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)