Summary

We provide a general probabilistic framework within which we establish scaling limits for a class of continuous-time stochastic volatility models with self-exciting jump dynamics. In the scaling limit, the joint dynamics of asset returns and volatility is driven by independent Gaussian white noises and two independent Poisson random measures that capture the arrival of exogenous shocks and the arrival of self-excited shocks, respectively. Various well-studied stochastic volatility models with and without self-exciting price/volatility co-jumps are obtained as special cases under different scaling regimes. We analyze the impact of external shocks on the market dynamics, especially their impact on jump cascades and show in a mathematically rigorous manner that many small external shocks may tigger endogenous jump cascades in asset returns and stock price volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

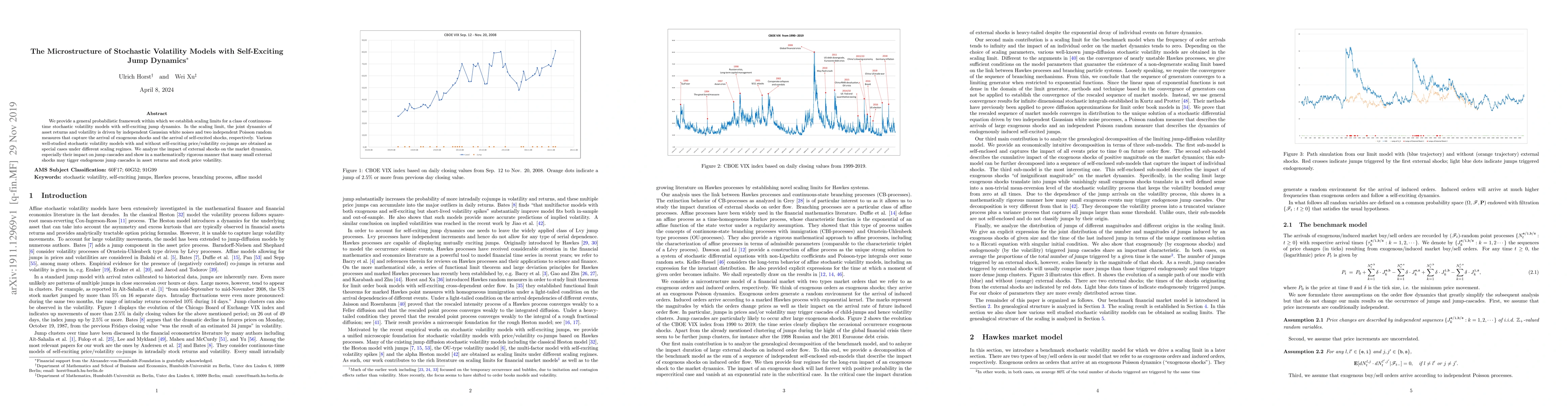

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)