Summary

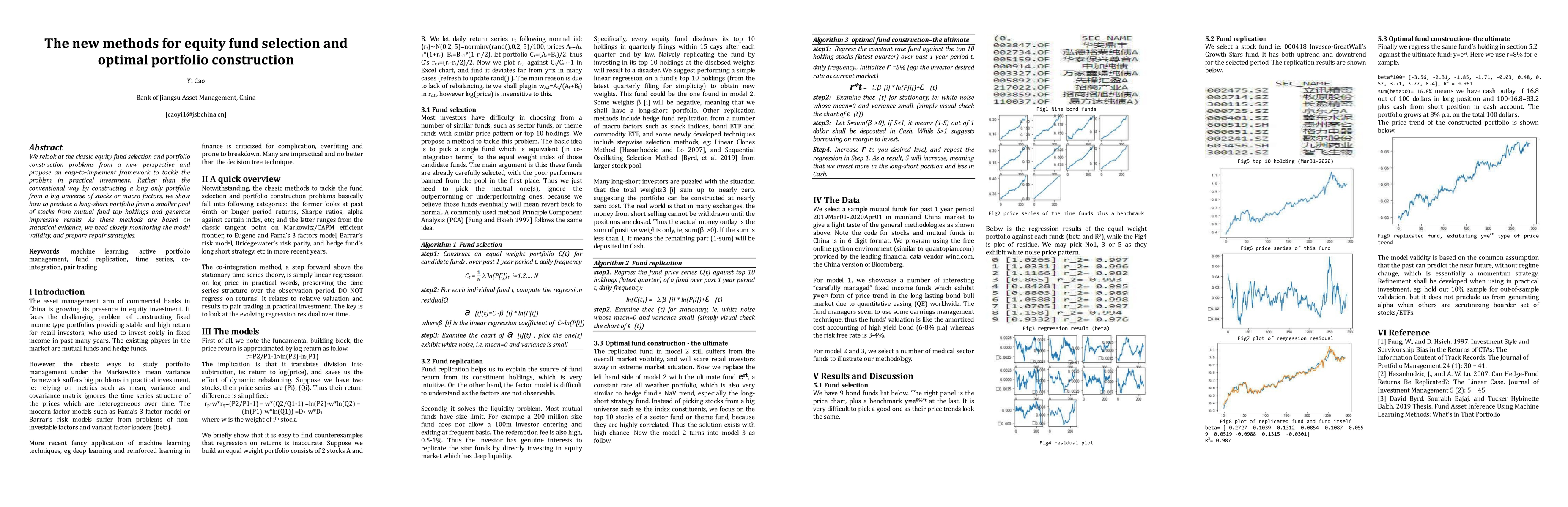

We relook at the classic equity fund selection and portfolio construction problems from a new perspective and propose an easy-to-implement framework to tackle the problem in practical investment. Rather than the conventional way by constructing a long only portfolio from a big universe of stocks or macro factors, we show how to produce a long-short portfolio from a smaller pool of stocks from mutual fund top holdings and generate impressive results. As these methods are based on statistical evidence, we need closely monitoring the model validity, and prepare repair strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedge Fund Portfolio Construction Using PolyModel Theory and iTransformer

Siqiao Zhao, Zhikang Dong, Zeyu Cao et al.

Randomized Signature Methods in Optimal Portfolio Selection

Josef Teichmann, Erdinc Akyildirim, Matteo Gambara et al.

No citations found for this paper.

Comments (0)