Summary

This study develops a multi-factor framework where not only market risk is considered but also potential changes in the investment opportunity set. Although previous studies find no clear evidence about a positive and significant relation between return and risk, favourable evidence can be obtained if a non-linear relation is pursued. The positive and significant risk-return trade-off is essentially observed during low volatility periods. However, this relationship is not obtained during periods of high volatility. Also, different patterns for the risk premium dynamics in low and high volatility periods are obtained both in prices of risk and market risk dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

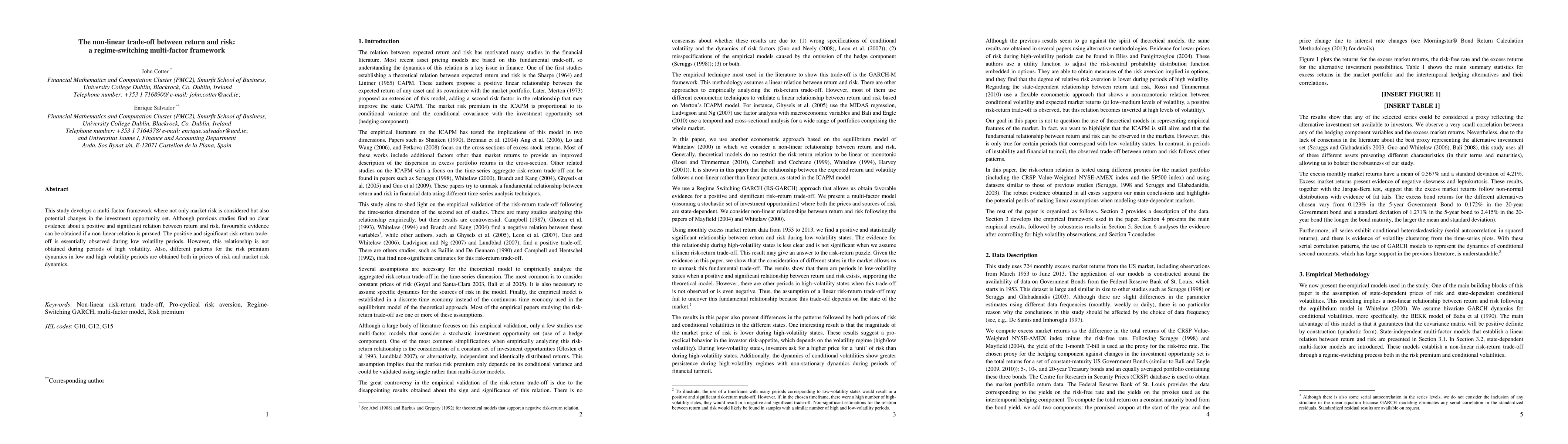

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)