Summary

This paper presents a probabilistic interpretation for the weak Sobolev solution of the obstacle problem for semilinear parabolic partial integro-differential equations (PIDEs). The results of Leandre (1985) concerning the homeomorphic property for the solution of SDEs with jumps are used to construct random test functions for the variational equation for such PIDEs. This results in the natural connection with the associated Reflected Backward Stochastic Differential Equations with jumps (RBSDEs), namely Feynman Kac's formula for the solution of the PIDEs. Moreover it gives an application to the pricing and hedging of contingent claims with constraints in the wealth or portfolio processes in financial markets including jumps.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

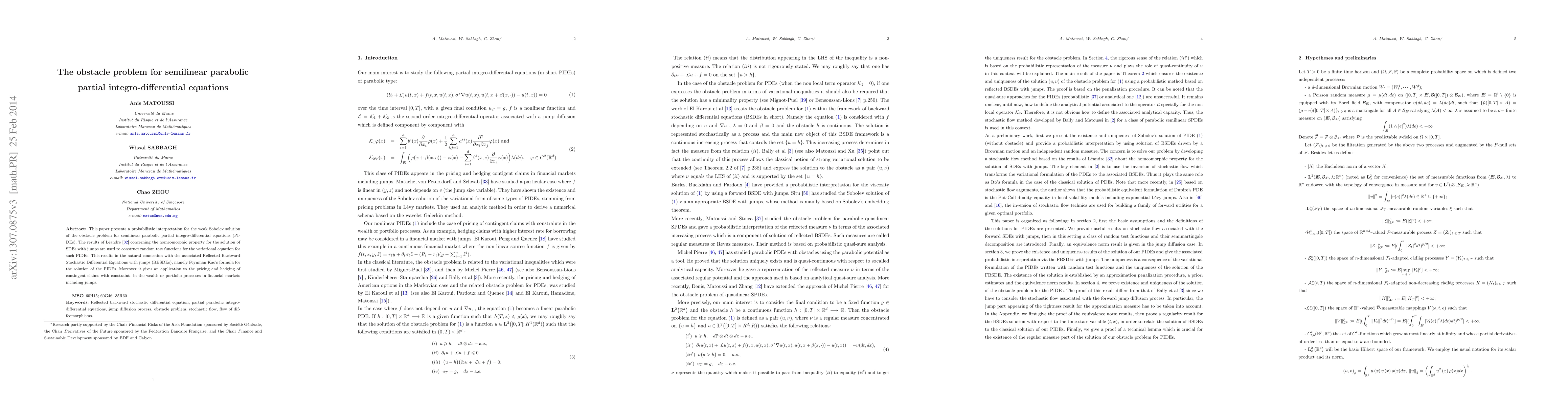

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDirichlet problem for semilinear partial integro-differential equations: the method of orthogonal projection

Andrzej Rozkosz, Tomasz Klimsiak

| Title | Authors | Year | Actions |

|---|

Comments (0)