Summary

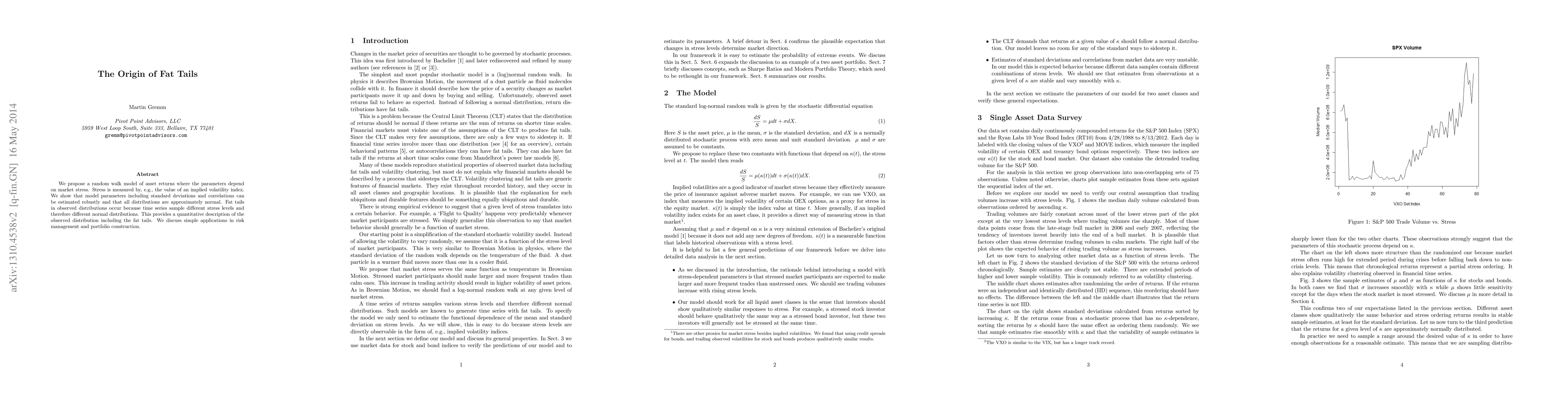

We propose a random walk model of asset returns where the parameters depend on market stress. Stress is measured by, e.g., the value of an implied volatility index. We show that model parameters including standard deviations and correlations can be estimated robustly and that all distributions are approximately normal. Fat tails in observed distributions occur because time series sample different stress levels and therefore different normal distributions. This provides a quantitative description of the observed distribution including the fat tails. We discuss simple applications in risk management and portfolio construction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)