Authors

Summary

The issue of local government debt is widely recognized as one of the "gray rhinos" affecting the stable development of China's economy. Government debt can transmit risks to local banks, which are among the primary holders of local debt, thereby triggering systemic financial risks. Consequently, exploring debt resolution pathways and evaluating the systematic effects of debt servicing policies has become critically important. This study employs panel data from 348 local commercial banks across 29 provincial-level administrative regions in China from 2010 to 2023, and constructs a difference-in-differences (DID) model to investigate the impact of the State Council's special supervision of debt servicing on local bank risks. The findings indicate that the government's debt servicing policy essentially represents a shift of government debt from explicit to implicit forms, significantly increasing the risks faced by local banks and producing outcomes contrary to the policy's original intent. This effect is particularly pronounced for rural commercial banks and banks with high customer concentration and fewer branches. Mechanism analysis reveals two key insights. First, local banks are heavily influenced by local government control; the government's debt servicing requires banks to support the government by purchasing government bonds and other financial instruments, which leads to a deterioration in asset quality and an expansion of risk exposure. Second, government debt crowds out private credit from local banks, weakening the region's repayment capacity and ultimately increasing bank risk. Our research uncovers the counterintuitive effects of government debt servicing and offers corresponding policy recommendations.

AI Key Findings

Generated Jun 11, 2025

Methodology

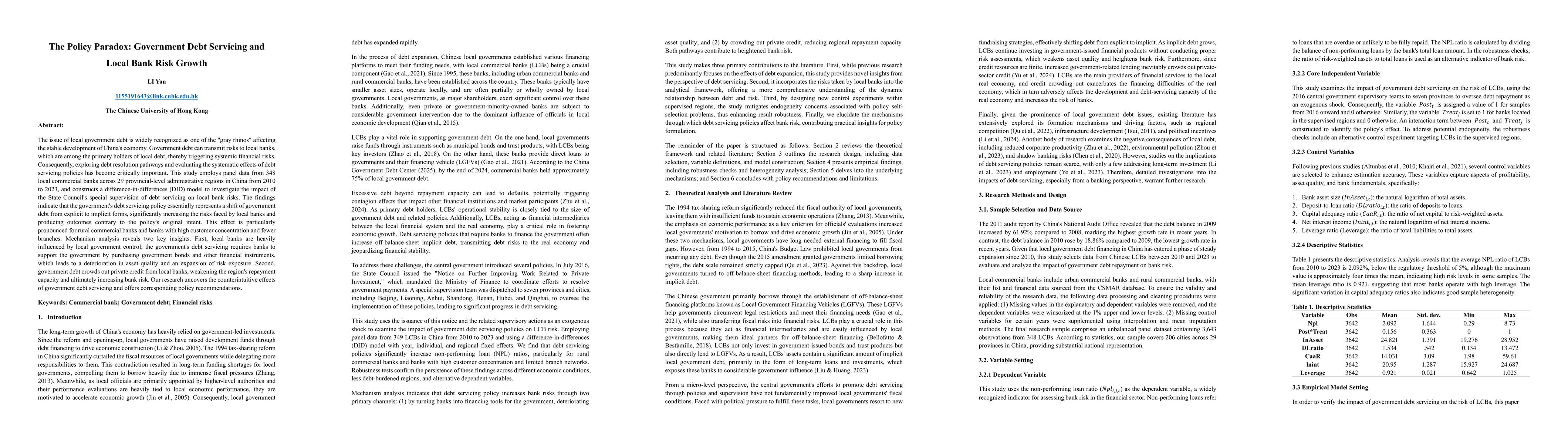

The study employs panel data from 348 local commercial banks across 29 provincial-level administrative regions in China from 2010 to 2023, constructing a difference-in-differences (DID) model to investigate the impact of the State Council's special supervision of debt servicing on local bank risks.

Key Results

- Government debt servicing policy significantly increases the risk faced by local commercial banks.

- The effect is more pronounced for rural commercial banks, banks with high customer concentration, and those with fewer branches.

- The policy essentially shifts government debt from explicit to implicit forms, deteriorating asset quality and expanding risk exposure.

- Government debt crowds out private credit from local banks, weakening the region's repayment capacity and increasing bank risk.

Significance

This research uncovers the counterintuitive effects of government debt servicing, offering policy recommendations for government governance, bank operations, and debt servicing.

Technical Contribution

The paper presents a detailed empirical analysis using a DID model to assess the impact of government debt servicing policies on local bank risks, addressing endogeneity concerns through PSM and a redesigned controlled experiment.

Novelty

This study provides new insights into the unintended consequences of government debt servicing policies on local bank risks, highlighting the importance of considering both explicit and implicit debt forms and their transmission channels.

Limitations

- The study does not account for potential external factors influencing bank risks not directly related to government debt servicing policies.

- Future research should consider constructing theoretical models to further enhance the robustness of conclusions.

Future Work

- Investigate the long-term impacts of government debt servicing policies on local banks.

- Explore the effects of these policies in different economic contexts and time periods.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonetary-Fiscal Interaction and the Liquidity of Government Debt

Cristiano Cantore, Edoardo Leonardi

Sovereign Debt Default and Climate Risk

Emilio Barucci, Daniele Marazzina, Aldo Nassigh

No citations found for this paper.

Comments (0)