Summary

We consider the design of private prediction markets, financial markets designed to elicit predictions about uncertain events without revealing too much information about market participants' actions or beliefs. Our goal is to design market mechanisms in which participants' trades or wagers influence the market's behavior in a way that leads to accurate predictions, yet no single participant has too much influence over what others are able to observe. We study the possibilities and limitations of such mechanisms using tools from differential privacy. We begin by designing a private one-shot wagering mechanism in which bettors specify a belief about the likelihood of a future event and a corresponding monetary wager. Wagers are redistributed among bettors in a way that more highly rewards those with accurate predictions. We provide a class of wagering mechanisms that are guaranteed to satisfy truthfulness, budget balance in expectation, and other desirable properties while additionally guaranteeing epsilon-joint differential privacy in the bettors' reported beliefs, and analyze the trade-off between the achievable level of privacy and the sensitivity of a bettor's payment to her own report. We then ask whether it is possible to obtain privacy in dynamic prediction markets, focusing our attention on the popular cost-function framework in which securities with payments linked to future events are bought and sold by an automated market maker. We show that under general conditions, it is impossible for such a market maker to simultaneously achieve bounded worst-case loss and epsilon-differential privacy without allowing the privacy guarantee to degrade extremely quickly as the number of trades grows, making such markets impractical in settings in which privacy is valued. We conclude by suggesting several avenues for potentially circumventing this lower bound.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

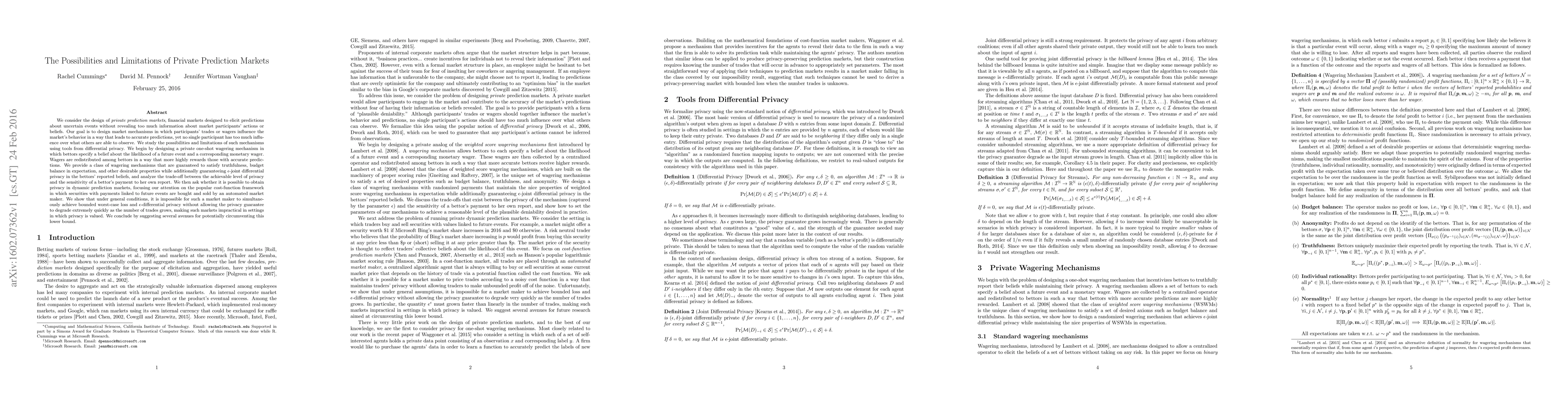

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDifferentially-Private Heat and Electricity Markets Coordination

Gabriela Hug, Lesia Mitridati, Ferdinando Fioretto et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)