Summary

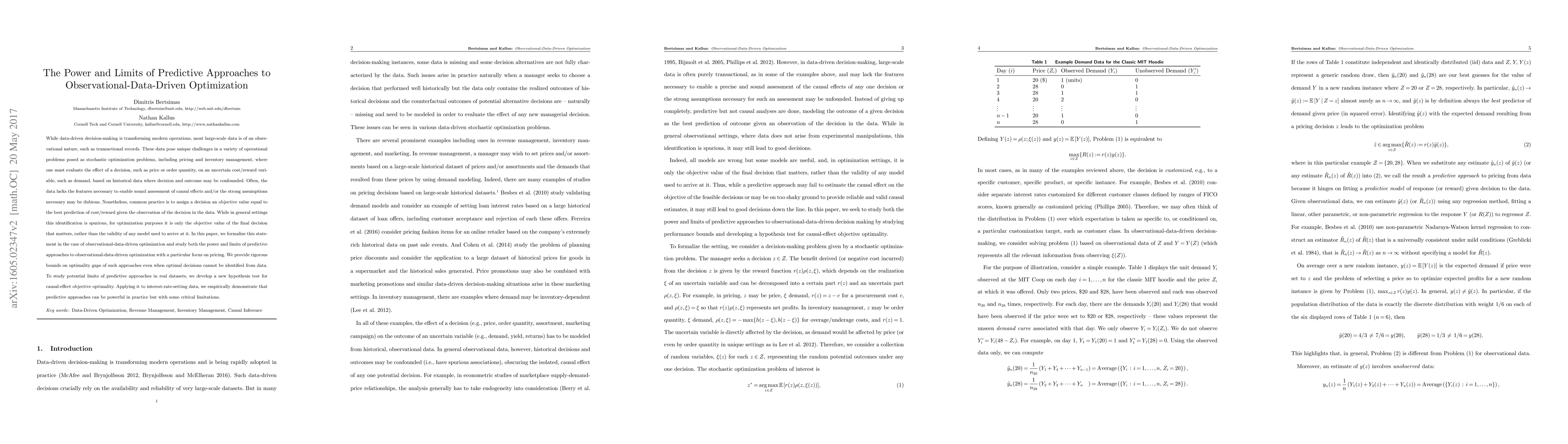

While data-driven decision-making is transforming modern operations, most large-scale data is of an observational nature, such as transactional records. These data pose unique challenges in a variety of operational problems posed as stochastic optimization problems, including pricing and inventory management, where one must evaluate the effect of a decision, such as price or order quantity, on an uncertain cost/reward variable, such as demand, based on historical data where decision and outcome may be confounded. Often, the data lacks the features necessary to enable sound assessment of causal effects and/or the strong assumptions necessary may be dubious. Nonetheless, common practice is to assign a decision an objective value equal to the best prediction of cost/reward given the observation of the decision in the data. While in general settings this identification is spurious, for optimization purposes it is only the objective value of the final decision that matters, rather than the validity of any model used to arrive at it. In this paper, we formalize this statement in the case of observational-data-driven optimization and study both the power and limits of predictive approaches to observational-data-driven optimization with a particular focus on pricing. We provide rigorous bounds on optimality gaps of such approaches even when optimal decisions cannot be identified from data. To study potential limits of predictive approaches in real datasets, we develop a new hypothesis test for causal-effect objective optimality. Applying it to interest-rate-setting data, we empirically demonstrate that predictive approaches can be powerful in practice but with some critical limitations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the equivalence of direct and indirect data-driven predictive control approaches

Valentina Breschi, Thomas B. Schön, Fabio Bonassi et al.

An Uncertainty-Aware Data-Driven Predictive Controller for Hybrid Power Plants

Sonja Glavaski, Himanshu Sharma, Sayak Mukherjee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)