Summary

We study the predictive power of industry-specific economic sentiment indicators for future macro-economic developments. In addition to the sentiment of firms towards their own business situation, we study their sentiment with respect to the banking sector - their main credit providers. The use of industry-specific sentiment indicators results in a high-dimensional forecasting problem. To identify the most predictive industries, we present a bootstrap Granger Causality test based on the Adaptive Lasso. This test is more powerful than the standard Wald test in such high-dimensional settings. Forecast accuracy is improved by using only the most predictive industries rather than all industries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

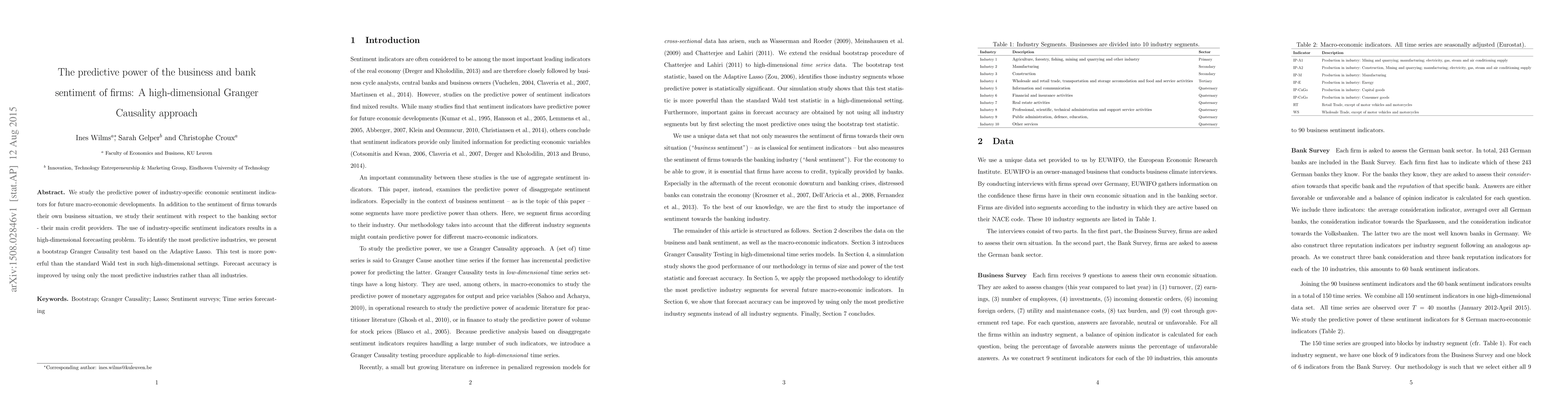

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)