Authors

Summary

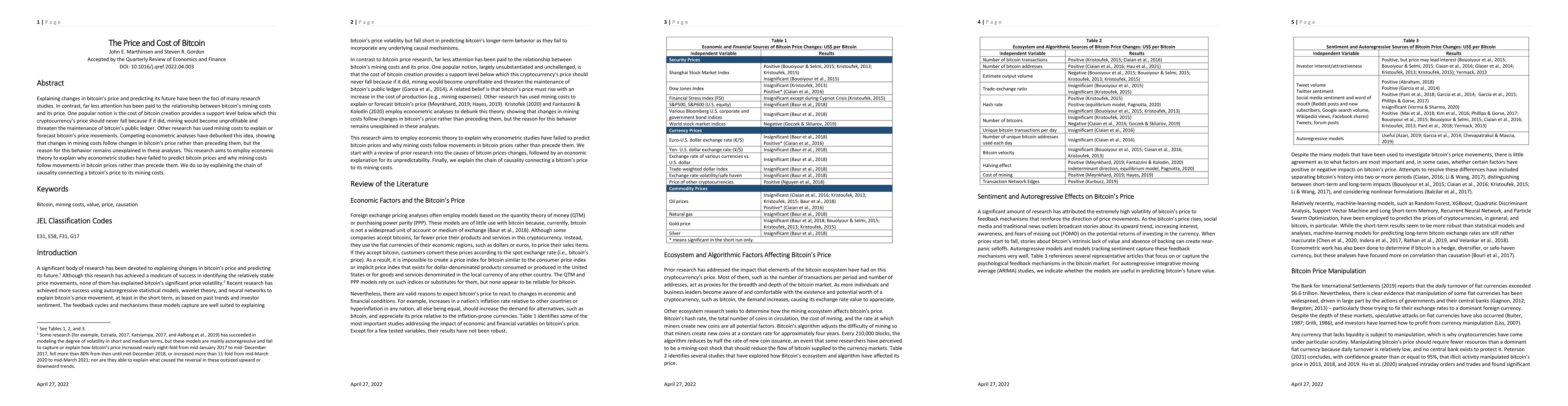

Explaining changes in bitcoin's price and predicting its future have been the foci of many research studies. In contrast, far less attention has been paid to the relationship between bitcoin's mining costs and its price. One popular notion is the cost of bitcoin creation provides a support level below which this cryptocurrency's price should never fall because if it did, mining would become unprofitable and threaten the maintenance of bitcoin's public ledger. Other research has used mining costs to explain or forecast bitcoin's price movements. Competing econometric analyses have debunked this idea, showing that changes in mining costs follow changes in bitcoin's price rather than preceding them, but the reason for this behavior remains unexplained in these analyses. This research aims to employ economic theory to explain why econometric studies have failed to predict bitcoin prices and why mining costs follow movements in bitcoin prices rather than precede them. We do so by explaining the chain of causality connecting a bitcoin's price to its mining costs.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)