Summary

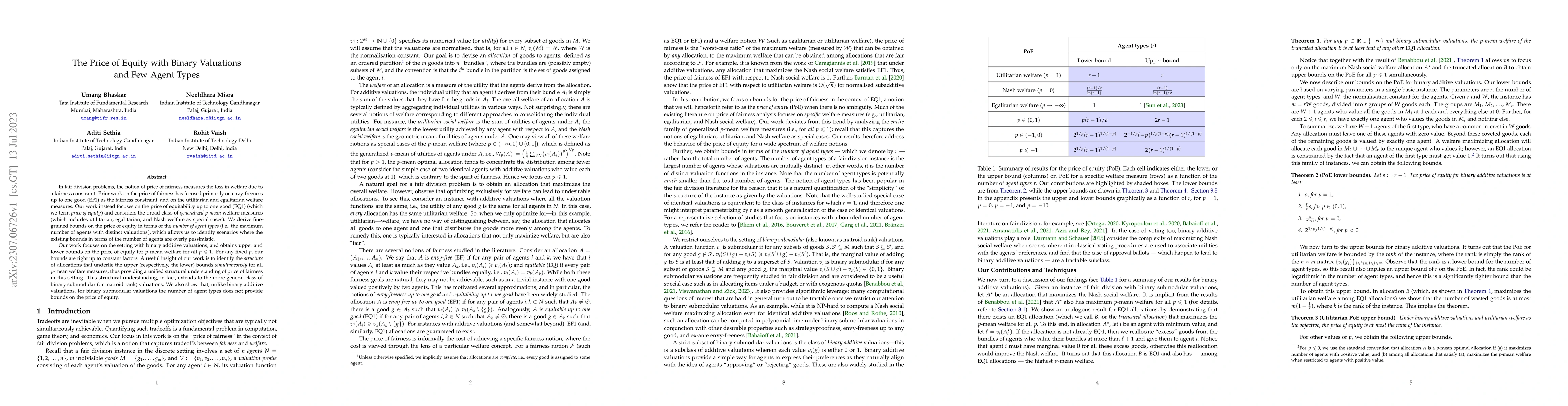

In fair division problems, the notion of price of fairness measures the loss in welfare due to a fairness constraint. Prior work on the price of fairness has focused primarily on envy-freeness up to one good (EF1) as the fairness constraint, and on the utilitarian and egalitarian welfare measures. Our work instead focuses on the price of equitability up to one good (EQ1) (which we term price of equity) and considers the broad class of generalized $p$-mean welfare measures (which includes utilitarian, egalitarian, and Nash welfare as special cases). We derive fine-grained bounds on the price of equity in terms of the number of agent types (i.e., the maximum number of agents with distinct valuations), which allows us to identify scenarios where the existing bounds in terms of the number of agents are overly pessimistic. Our work focuses on the setting with binary additive valuations, and obtains upper and lower bounds on the price of equity for $p$-mean welfare for all $p \leqslant 1$. For any fixed $p$, our bounds are tight up to constant factors. A useful insight of our work is to identify the structure of allocations that underlie the upper (respectively, the lower) bounds simultaneously for all $p$-mean welfare measures, thus providing a unified structural understanding of price of fairness in this setting. This structural understanding, in fact, extends to the more general class of binary submodular (or matroid rank) valuations. We also show that, unlike binary additive valuations, for binary submodular valuations the number of agent types does not provide bounds on the price of equity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproximating APS under Submodular and XOS valuations with Binary Marginals

Ruta Mehta, Pooja Kulkarni, Rucha Kulkarni

| Title | Authors | Year | Actions |

|---|

Comments (0)