Summary

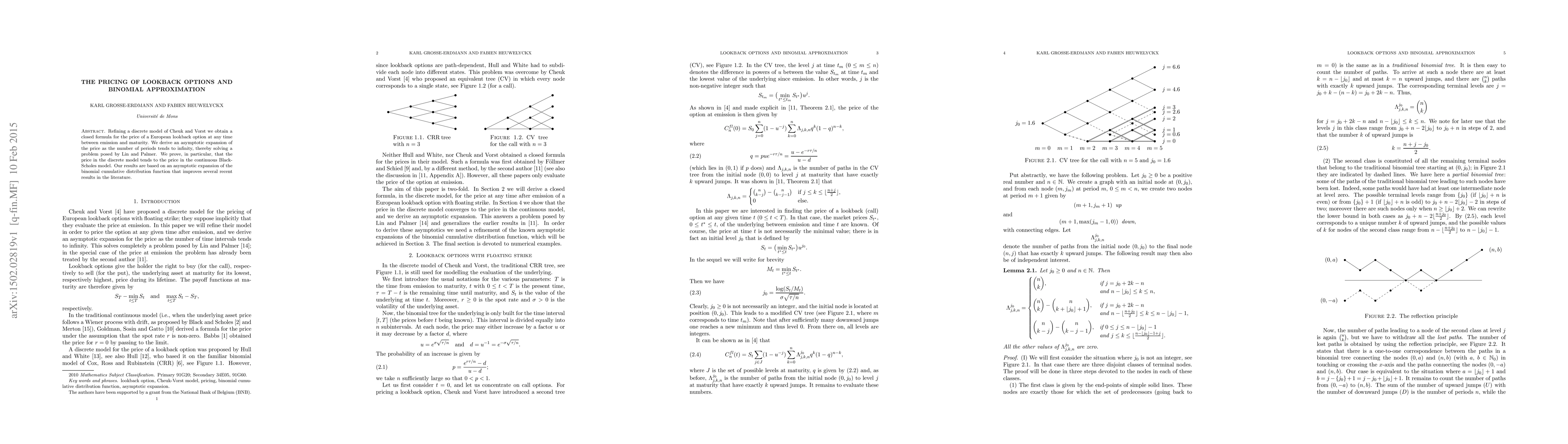

Refining a discrete model of Cheuk and Vorst we obtain a closed formula for the price of a European lookback option at any time between emission and maturity. We derive an asymptotic expansion of the price as the number of periods tends to infinity, thereby solving a problem posed by Lin and Palmer. We prove, in particular, that the price in the discrete model tends to the price in the continuous Black-Scholes model. Our results are based on an asymptotic expansion of the binomial cumulative distribution function that improves several recent results in the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)