Summary

The 2007--2008 financial crisis has paved the way for the use of macroprudential policies in supervising the financial system as a whole. This paper views macroprudential oversight in Europe as a process, a sequence of activities with the ultimate aim of safeguarding financial stability. To conceptualize a process in this context, we introduce the notion of a public collaborative process (PCP). PCPs involve multiple organizations with a common objective, where a number of dispersed organizations cooperate under various unstructured forms and take a collaborative approach to reaching the final goal. We argue that PCPs can and should essentially be managed using the tools and practices common for business processes. To this end, we conduct an assessment of process readiness for macroprudential oversight in Europe. Based upon interviews with key European policymakers and supervisors, we provide an analysis model to assess the maturity of five process enablers for macroprudential oversight. With the results of our analysis, we give clear recommendations on the areas that need further attention when macroprudential oversight is being developed, in addition to providing a general purpose framework for monitoring the impact of improvement efforts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

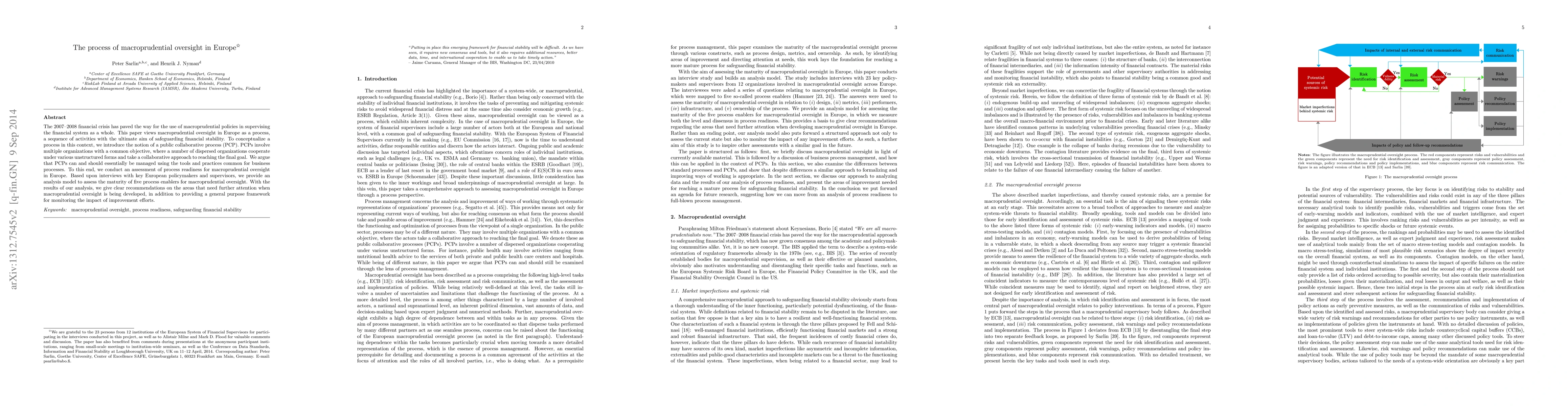

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSecure Human Oversight of AI: Exploring the Attack Surface of Human Oversight

Kevin Baum, Carola Plesch, Markus Langer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)