Summary

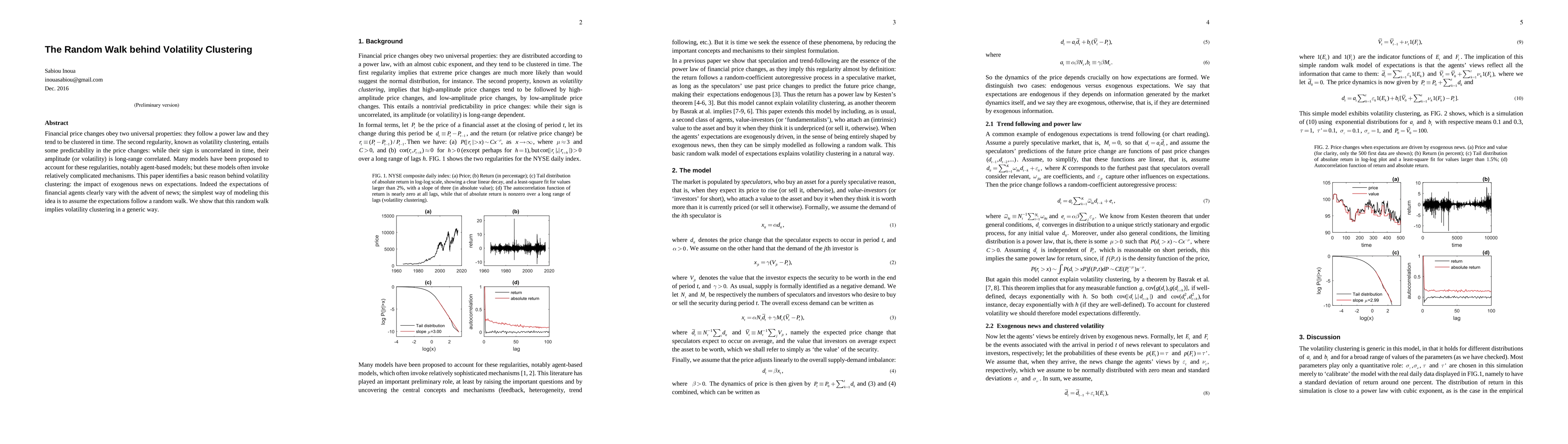

Financial price changes obey two universal properties: they follow a power law and they tend to be clustered in time. The second regularity, known as volatility clustering, entails some predictability in the price changes: while their sign is uncorrelated in time, their amplitude (or volatility) is long-range correlated. Many models have been proposed to account for these regularities, notably agent-based models; but these models often invoke relatively complicated mechanisms. This paper identifies a basic reason behind volatility clustering: the impact of exogenous news on expectations. Indeed the expectations of financial agents clearly vary with the advent of news; the simplest way of modeling this idea is to assume the expectations follow a random walk. We show that this random walk implies volatility clustering in a generic way.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLocally Adaptive Random Walk Stochastic Volatility

David S. Matteson, Jason B. Cho

Clustering for directed graphs using parametrized random walk diffusion kernels

Argyris Kalogeratos, Matthieu Jonckheere, Harry Sevi

| Title | Authors | Year | Actions |

|---|

Comments (0)