Summary

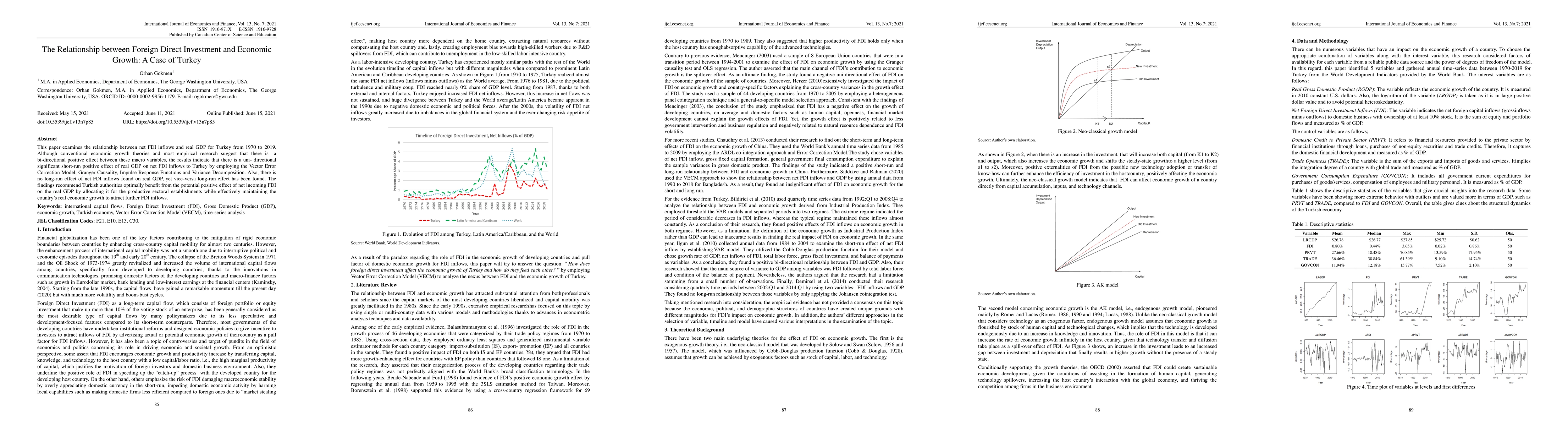

This paper examines the relationship between net FDI inflows and real GDP for Turkey from 1970 to 2019. Although conventional economic growth theories and most empirical research suggest that there is a bi-directional positive effect between these macro variables, the results indicate that there is a uni-directional significant short-run positive effect of real GDP on net FDI inflows to Turkey by employing the Vector Error Correction Model, Granger Causality, Impulse Response Functions and Variance Decomposition. Also, there is no long-run effect has been found. The findings recommend Turkish authorities optimally benefit from the potential positive effect of net incoming FDI on the real GDP by allocating it for the productive sectoral establishments while effectively maintaining the country's real economic growth to attract further FDI inflows.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForeign Capital and Economic Growth: Evidence from Bangladesh

Ummya Salma, Md. Fazlul Huq Khan, Md. Masum Billah

Foreign Direct Investment and Job Creation in EU Regions

Marjan Petreski, Magdalena Olczyk

| Title | Authors | Year | Actions |

|---|

Comments (0)