Summary

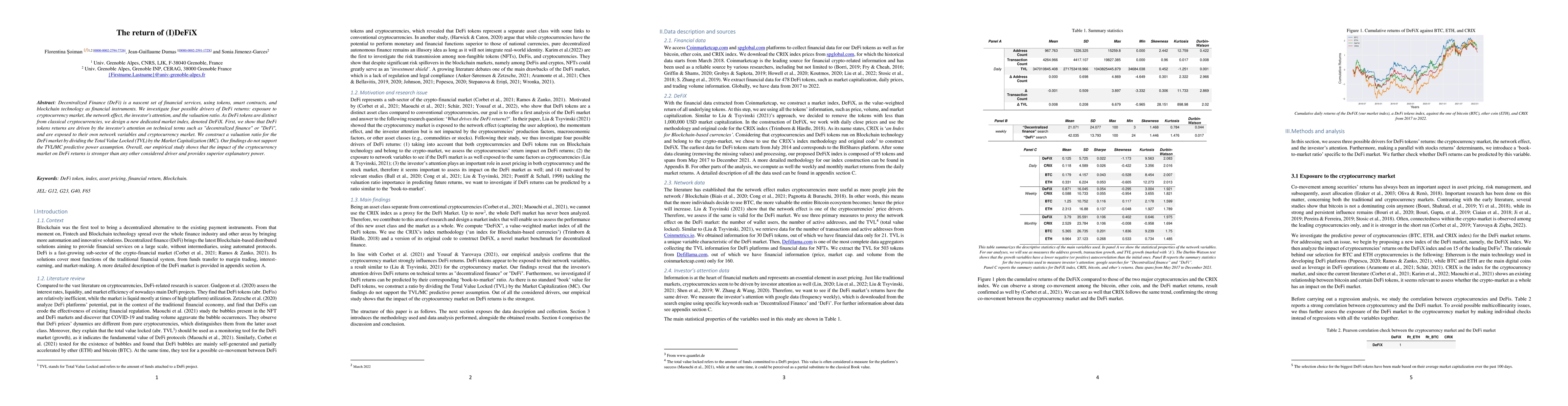

Decentralized Finance (DeFi) is a nascent set of financial services, using tokens, smart contracts, and blockchain technology as financial instruments. We investigate four possible drivers of DeFi returns: exposure to cryptocurrency market, the network effect, the investor's attention, and the valuation ratio. As DeFi tokens are distinct from classical cryptocurrencies, we design a new dedicated market index, denoted DeFiX. First, we show that DeFi tokens returns are driven by the investor's attention on technical terms such as "decentralized finance" or "DeFi", and are exposed to their own network variables and cryptocurrency market. We construct a valuation ratio for the DeFi market by dividing the Total Value Locked (TVL) by the Market Capitalization (MC). Our findings do not support the TVL/MC predictive power assumption. Overall, our empirical study shows that the impact of the cryptocurrency market on DeFi returns is stronger than any other considered driver and provides superior explanatory power.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeFIX: Detecting and Fixing Failure Scenarios with Reinforcement Learning in Imitation Learning Based Autonomous Driving

Nazim Kemal Ure, Resul Dagdanov, Halil Durmus et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)