Authors

Summary

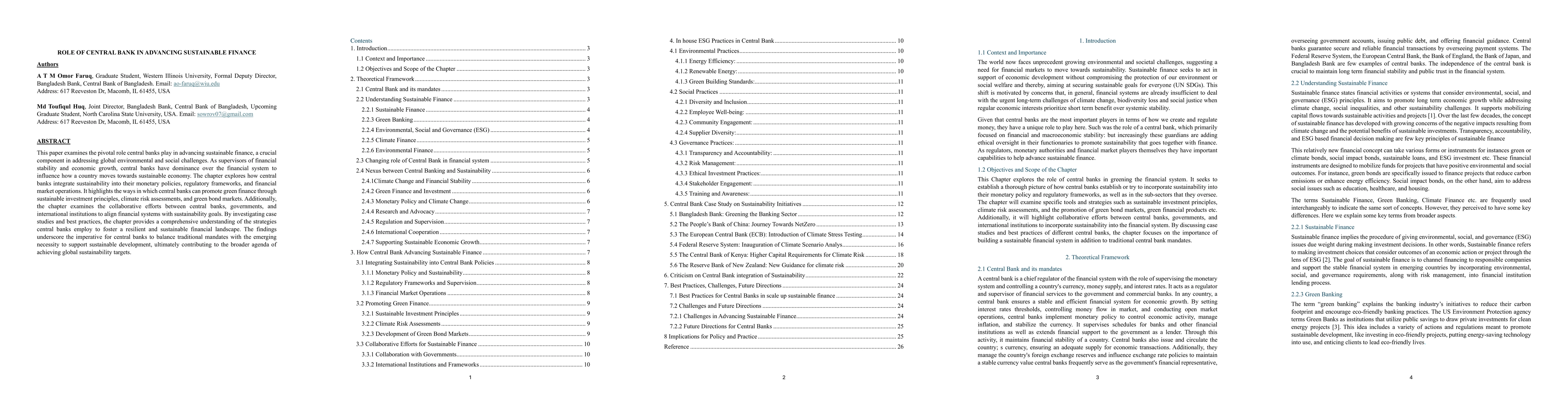

This paper examines the pivotal role central banks play in advancing sustainable finance, a crucial component in addressing global environmental and social challenges. As supervisors of financial stability and economic growth, central banks have dominance over the financial system to influence how a country moves towards sustainable economy. The chapter explores how central banks integrate sustainability into their monetary policies, regulatory frameworks, and financial market operations. It highlights the ways in which central banks can promote green finance through sustainable investment principles, climate risk assessments, and green bond markets. Additionally, the chapter examines the collaborative efforts between central banks, governments, and international institutions to align financial systems with sustainability goals. By investigating case studies and best practices, the chapter provides a comprehensive understanding of the strategies central banks employ to foster a resilient and sustainable financial landscape. The findings underscore the imperative for central banks to balance traditional mandates with the emerging necessity to support sustainable development, ultimately contributing to the broader agenda of achieving global sustainability targets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCentral Bank Digital Currency with Collateral-constrained Banks

Hanfeng Chen, Maria Elena Filippin

The independence of Central Banks, a reductio ad impossibile

Ion Pohoata, Delia-Elena Diaconasu, Ioana Negru

| Title | Authors | Year | Actions |

|---|

Comments (0)