Authors

Summary

The fragility of financial systems was starkly demonstrated in early 2023 through a cascade of major bank failures in the United States, including the second, third, and fourth largest collapses in the US history. The highly interdependent financial networks and the associated high systemic risk have been deemed the cause of the crashes. The goal of this paper is to enhance existing systemic risk analysis frameworks by incorporating essential debt valuation factors. Our results demonstrate that these additional elements substantially influence the outcomes of risk assessment. Notably, by modeling the dynamic relationship between interest rates and banks' credibility, our framework can detect potential cascading failures that standard approaches might miss. The proposed risk assessment methodology can help regulatory bodies prevent future failures, while also allowing companies to more accurately predict turmoil periods and strengthen their survivability during such events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

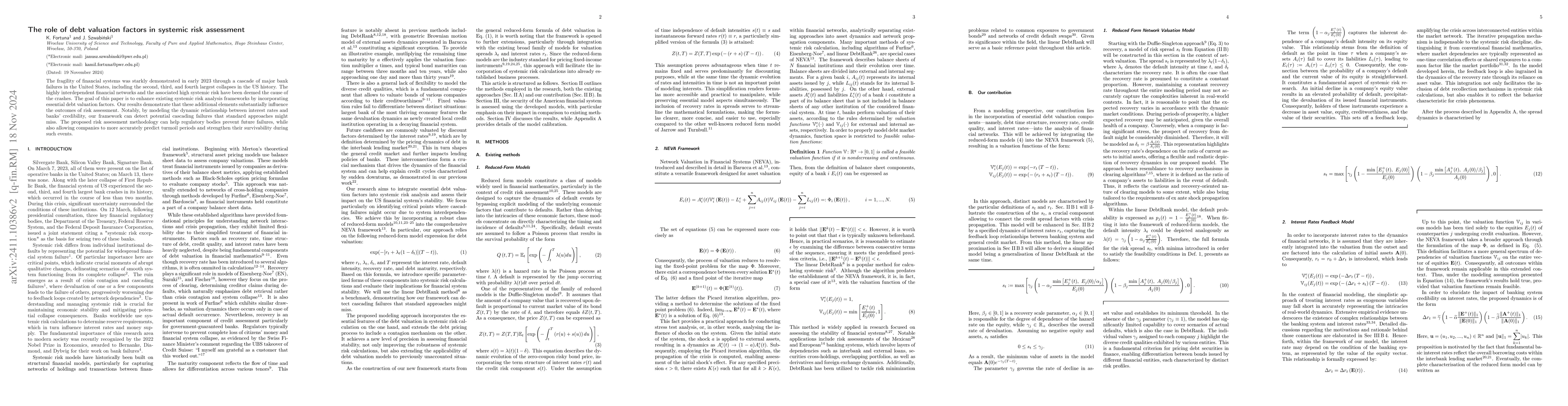

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSovereign Debt Default and Climate Risk

Emilio Barucci, Daniele Marazzina, Aldo Nassigh

No citations found for this paper.

Comments (0)