Authors

Summary

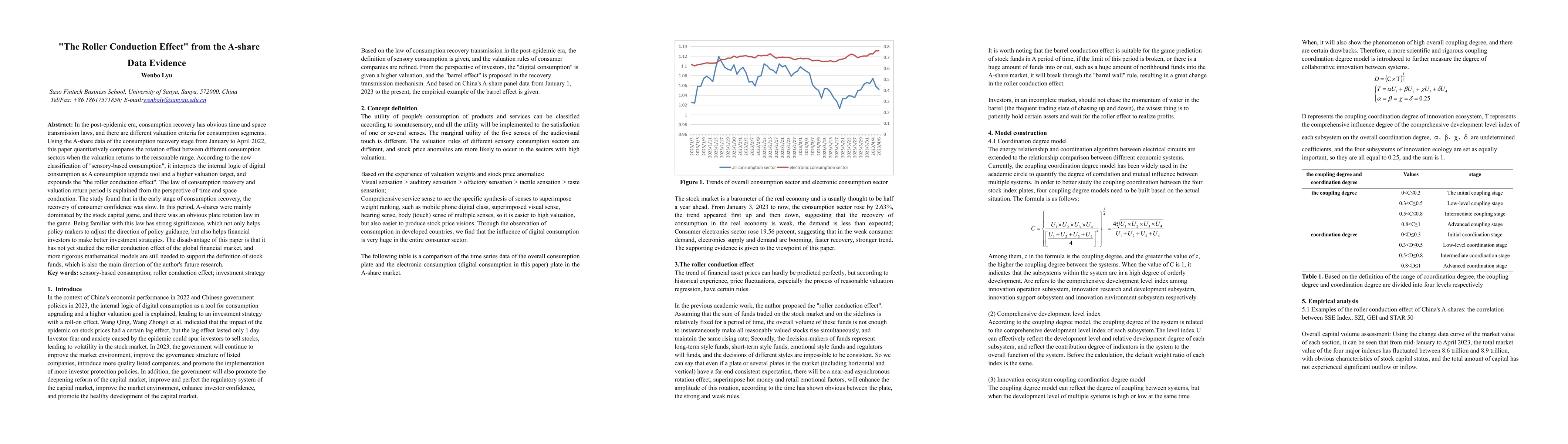

In the post-epidemic era, consumption recovery has obvious time and space transmission laws, and there are different valuation criteria for consumption segments. Using the A-share data of the consumption recovery stage from January to April 2022, this paper quantitatively compares the rotation effect between different consumption sectors when the valuation returns to the reasonable range. According to the new classification of "sensory-based consumption", it interprets the internal logic of digital consumption as A consumption upgrade tool and a higher valuation target, and expounds the "the roller conduction effect". The law of consumption recovery and valuation return period is explained from the perspective of time and space conduction. The study found that in the early stage of consumption recovery, the recovery of consumer confidence was slow. In this period, A-shares were mainly dominated by the stock capital game, and there was an obvious plate rotation law in the game. Being familiar with this law has strong significance, which not only helps policy makers to adjust the direction of policy guidance, but also helps financial investors to make better investment strategies. The disadvantage of this paper is that it has not yet studied the roller conduction effect of the global financial market, and more rigorous mathematical models are still needed to support the definition of stock funds, which is also the main direction of the author's future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)